Council not collecting enough money

By local democracy reporter Brendon McMahon:

The West Coast Regional Council is being warned it is not collecting enough money from rates, and will need to consider using its investments again to subsidise rates.

The council's financial manager raised the matter as it received a report on its investment portfolio at a Risk and Assurance Committee meeting on February 20.

Committee chairperson Frank Dooley said fund manager JB Were had advised "a cautious stance" over divesting its portfolio.

Acting corporate services manager Aaron Prendergast said the draft long-term plan suggested using funds generated from this portfolio to reduce rates.

The council was "under rating".

"It is timely for some of those decisions around how the portfolio operates," he said.

Dooley said the council's rates income should generate debate again this year.

He repeated his previous stance that council could not afford to keep rates down if it were to meet its statutory responsibilities.

"This council has under rated for a number of years, and as a result we have accumulated a number of deficits," he said.

"As we go through the LTP consultation phase I think this is something that will be … debated quite rigorously."

That included the role of the investment portfolio and rates income, Dooley said.

The ouncil's investment fund closed for the six months to December 31 at just over $13 million, $431,484 higher from July 1 ($12.57m).

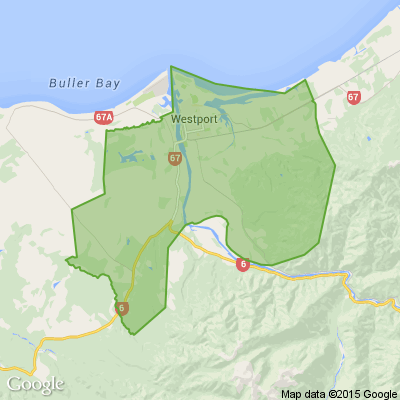

Its catastrophe fund sat at $495,817 while awaiting the $1m previously spent in Westport in 2022.

According to the investment report, the council owes $11.4m via the Local Government Funding Agency, and nearly $2m under a 'multi-option credit loan' with Westpac.

Prendergast said the council needed to weigh up its investment and its capacity to use that to subsidise rates increases.

"I think the quantum if we were to reinvest as opposed to subsidise rates is about $1 million a year," he said.

Councillor Brett Cummings said council had previously used investment income to subsidise rates income, but this saw the investment fund growth rate slowly decrease.

Subsequently, the council chose to build up the main fund again, with the last withdrawal in 2021.

Dooley was the sole dissenter against the 2023-24 increase of 16.4%, saying it needed to be much higher.

Meantime, some ratepayers are still unclear what their total 2023-24 rates bills will be.

Poll: Are our Kiwi summer holidays helping us recharge, or holding the economy back? ☀️🥝

There’s growing debate about whether New Zealand’s extended Christmas break (and the slowdown that comes with it) affects productivity.

Tracy Watkins has weighed in ... now it’s your turn. What’s your take? 🤔

-

72% We work hard, we deserve a break!

-

16.3% Hmm, maybe?

-

11.7% Yes!

Some Choice News!

Many New Zealand gardens aren’t seeing as many monarch butterflies fluttering around their swan plants and flower beds these days — the hungry Asian paper wasp has been taking its toll.

Thanks to people like Alan Baldick, who’s made it his mission to protect the monarch, his neighbours still get to enjoy these beautiful butterflies in their own backyards.

Thinking about planting something to invite more butterflies, bees, and birds into your garden?

Thanks for your mahi, Alan! We hope this brings a smile!

Your Christmas shopping just got easier

Mags4gifts.co.nz is having a Christmas sale with up to 40% off best-selling magazine subscriptions, including NZ Gardener, NZ House & Garden and TV Guide. Add a free e-card at checkout and schedule it to arrive on Christmas morning for a perfectly timed surprise! Make Christmas thoughtful this year with a gift that lasts long after the holidays are over.

Loading…

Loading…