Seven Essential Things You Should Know If You Want To Flip Houses

1. BUY SMART

As they say, you make your money when you buy. It doesn’t matter how amazing your renovation is, if you have overpaid for the property, it is already eating into any potential profit. Leave your emotions at the door and use your head, not your heart, when purchasing.

2. RESEARCH

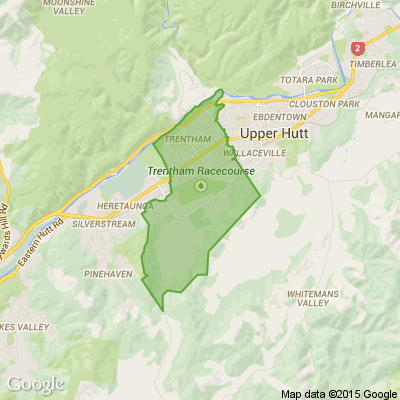

Research the suburb’s sales history so you know the house is at the right price and learn what you could potentially sell the property for when the renovation is complete. Once you are interested in a property, do all the due diligence required – have your lawyer go over the LIM, get a building inspection and talk to the neighbours about the area.

3. KNOW THE TAX RULES

Employ a trusted lawyer and accountant and find out what your legal and tax obligations are. The current law states if you buy a property with the intention of reselling it, or buy a home as part of your property or building business, you will have to pay tax on any profit from the sale. If you buy and sell a property within two years (this is currently under review), you’ll pay tax on any profit (with some exclusions, eg your main home is excluded). You may also have to pay tax on profit if you have a history of buying and selling properties, or if you’re associated with the property industry. For details, see ird.govt.nz/property

4. PLAN, PLAN, PLAN

You can download budget planners which detail all the costs involved in buying, renovating and selling a house. These cover purchasing costs (building inspection, lawyer, accountant), holding costs (mortgage payments, rates, insurance), renovation costs (council consents, builders, tradies, fixtures and fittings) and selling costs (agent’s fees, lawyer and accountant).

5. COUNT ON QUOTES

Get several quotes for work required and clarify the scope of work you are paying for, eg will you project manage or will the builder? Will you source each tradie or will your builder give one fixed price for the entire job? This process is time-consuming but important.

6. MAKE IT QUICK

Aim to complete the renovation and get the house back on the market as quickly as possible, so you are selling in the same market you bought in. This will protect you from any potential market downturn and ensure holding costs like mortgage repayments, rates and insurance are as low as possible. Although this renovation took longer than anticipated due to an unprecedented building boom in the area, house values were increasing at such a rapid rate that the extra costs incurred were outweighed by the increase in the property’s value.

7. EXPECT THE UNEXPECTED

Our budget ran over by about 10 percent, which is common when renovating. Other than a new joist needed in the bathroom floor, everything else was in mint condition. However, the renovation wasn’t without its lows. There was one awful moment a few days before the Readylawn was to be laid, when we found out that a large, deep trench had to be dug through the newly laid driveway and across the entire front yard. Incredibly, it was fixed within 24 hours and the drainage boys then levelled out the ground, meaning one less job for us before the lawn was laid.

The other bad experience involved a tradie who was booked to do the driveway but took my money and skipped town. That’s an extra tip – never pay before work is complete.

What word sums up 2024, neighbours?

If 2020 was the year of lockdowns, banana bread, and WFH (work from home)....

In one word, how would you define 2024?

We're excited to see what you come up with!

⚠️ DOGS DIE IN HOT CARS. If you love them, don't leave them. ⚠️

It's a message we share time and time again, and this year, we're calling on you to help us spread that message further.

Did you know that calls to SPCA about dogs left inside hot cars made up a whopping 11% of all welfare calls last summer? This is a completely preventable issue, and one which is causing hundreds of dogs (often loved pets) to suffer.

Here are some quick facts to share with the dog owners in your life:

👉 The temperature inside a car can heat to over 50°C in less than 15 minutes.

👉 Parking in the shade and cracking windows does little to help on a warm day. Dogs rely on panting to keep cool, which they can't do in a hot car.

👉 This puts dogs at a high risk of heatstroke - a serious condition for dogs, with a mortality rate between 39%-50%.

👉 It is an offence under the Animal Welfare Act to leave a dog in a hot vehicle if they are showing signs of heat stress. You can be fined, and prosecuted.

SPCA has created downloadable resources to help you spread the message even further. Posters, a flyer, and a social media tile can be downloaded from our website here: www.spca.nz...

We encourage you to use these - and ask your local businesses to display the posters if they can. Flyers can be kept in your car and handed out as needed.

This is a community problem, and one we cannot solve alone. Help us to prevent more tragedies this summer by sharing this post.

On behalf of the animals - thank you ❤️

Loading…

Loading…