How to turn your home into an investment property

Not everyone chooses to sell their current home when they decide to move on. Sometimes, it’s not even an option. If you’re looking to hang on to your personal home and turn it into a rental, there are a few things to consider first.

1. Wear and tear

This is perhaps the biggest thing homeowners need to know. As a rental, your personal home will experience more wear and tear than it otherwise would if you lived in it. Your garden will probably not look as immaculate as it once did, and your walls and floors may acquire new scuff marks. So, if you can’t shake off your emotional attachment to the property, you may be better off selling it rather than renting it.

2. Location

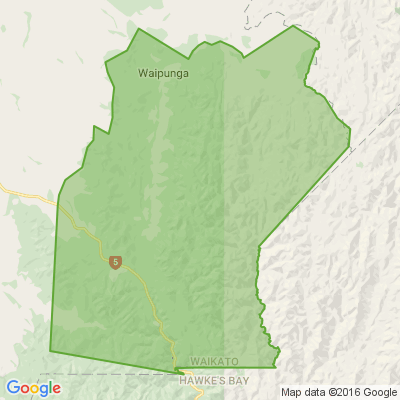

The location of your home can have a major impact on its rentability and how easy it is to find quality tenants. If you’re close to local amenities like schools, Waikato University, Waikato Hospital or public transport routes, you have a better chance of keeping your property tenanted.

3. Maintenance

If your home is high maintenance - perhaps it has a pool, a large garden, or old appliances - know that you’ll need to keep it maintained to a reasonable condition to meet your obligations as a landlord/owner. This may involve extra ongoing costs, or costs to remedy the amount of maintenance required.

4. Family homes do best

In Hamilton, family-sized homes do particularly well on the rental market. Four-bedroom houses in Hamilton fetch, on average, between $450 and $520 per week. As for the strongest performing suburbs, Hamilton East/University, Te Kowhai/St Andrews/Queenwood, Dinsdale South/Frankton, Dinsdale North/Nawton and Flagstaff/Rototuna have recently experienced the strongest rental growth for family-sized properties with three to five (or more) bedrooms.

5. Landlord responsibilities

When you turn your personal home into a rental, you will take on the mantle of landlord, which comes with its own set of responsibilities. This includes finding and screening tenants, conducting or arranging inspections, repairs and maintenance. It’s a lot to manage—especially if you’re no longer living in the region. It’s why so many investors hire professional property managers to take care of the day-to-day running of their properties. Moreover, their fees are tax deductible.

Important note: If you’re leaving the country for more than 21 days, you’ll need to either appoint someone as your landlord in your stead or hire a property manager.

6. Tax implications

If you turn your home into a residential investment, be aware that you may not be able to make tax claims against it. It always pays to talk to a professional accountant to make sure you set up your home-turned-rental properly to avoid issues with tax, ownership and debt allocation.

Win this brand new home!

Experience the perfect blend of country charm and city convenience in Clarks Beach, Auckland!

For just $15 a ticket, you could win this brand-new, fully furnished Jennian home, valued at over $1 million.

This home offers three bedrooms, spacious kitchen and living areas, and a double garage.

Whether you decide to make it your dream home, a holiday retreat, a rental property or simply sell it, it’s still a life-changing prize.

Don’t wait—get your tickets today at heartlottery.org.nz.

What's your favourite recipe for courgettes?

Kia ora neighbours. If you've got a family recipe for courgettes, we'd love to see it and maybe publish it in our magazine. Send your recipe to mailbox@nzgardener.co.nz, and if we use it in the mag, you will receive a free copy of our January 2025 issue.

Poll: Should all neighbours have to contribute to improvements?

An Auckland court has ruled a woman doesn’t have to contribute towards the cost of fixing a driveway she shares with 10 neighbours.

When thinking about fences, driveways or tree felling, for example, do you think all neighbours should have to pay if the improvements directly benefit them?

-

82.2% Yes

-

15.2% No

-

2.6% Other - I'll share below

Loading…

Loading…