Stereo system

Yamaha amplifier

Technics

Kenwood Speakers

Veon Turntable

Has been in storage for many years, plugged it all up and it’s in working order, needs a good clean.

🧩 Can You Put the Pieces Together? Give It a Go! 🕶️

Give this puzzle a whirl, can you figure it out?

Do you think you know the answer? Simply 'Like' this post if you know the answer and the big reveal will be posted in the comments at 2pm on the day!

Want to stop seeing these in your newsfeed?

Head here and hover on the Following button on the top right of the page (and it will show Unfollow) and then click it. If it is giving you the option to Follow, then you've successfully unfollowed the Riddles page.

Buying a Home? Take a Breath — You’ve Got This 🏡✨

If you’ve started doing a bit of research online, chances are you’ve come across this line:

“Buying a home is one of the biggest investments you’ll ever make.”

It’s everywhere. And while it is true, it can also feel a bit... overwhelming. Like, no pressure, right?

But here’s the thing — yes, buying a home is a significant financial decision, but it’s also so much more than just numbers. You’re not just investing in property — you’re choosing a space to live your life, to create memories, to feel safe and settled. This is about building your future, not just your portfolio.

Feeling a little panicky is totally normal — but there are some simple steps that can help you move forward with confidence:

✨ Learn as much as you can about the process

✨ Get yourself prepared ahead of time

✨ Take it one step at a time — in the right order

And the best part? You don’t have to do it alone. A knowledgeable, local real estate agent (👋 hello!) can walk beside you from start to finish, helping you make sense of everything and keeping it all on track.

This is your journey — let’s make it a good one. 🏠💛

✅ Step 1: Financial Foundations

• Check your credit score

• Fix any issues on your credit report

• Start saving for:

o Deposit (usually 10–20% of the purchase price)

o Additional costs:

* LIM Report

* Builders Report

* Registered Valuation

* Lawyer’s fees

* Moving costs

• Talk to your bank and a mortgage broker

• Apply for mortgage preapproval from multiple lenders

• Compare interest rates, terms, and loan features

✅ Step 2: Define Your Dream Home

• Set your budget based on preapproval

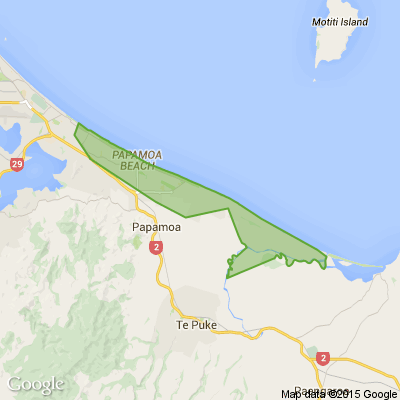

• Choose your preferred Tauranga suburbs (e.g., Bethlehem, Papamoa, The Lakes, Otumoetai, Mt Maunganui etc)

• Create a list of:

o Must-haves (e.g. 3 bedrooms, double garage, close to schools)

o Nice-to-haves (e.g. sea view, home office, big backyard)

• Prioritise your list

• Share your wishlist with your real estate agent

✅ Step 3: Choose the Right Agent

• Talk to at least two or three local agents

• Ask about their experience in your target areas

• Pay attention to:

o Communication style

o Local knowledge

o Whether they listen to your needs

o If you feel comfortable with them

✅ Step 4: Get Informed

• Ask your agent for blank copies of the forms you’ll be signing

• Learn the process of:

o Making an offer

o Conditional vs. unconditional contracts

o Settlement day

• Ask questions about anything you don’t understand

• Keep your paperwork organised

✅ Extra Tips

• Stay flexible- perfect homes rarely exist, but the right one will feel right

• Keep emotions in check during negotiations

• Don’t skip due diligence—even if the home looks great

• Celebrate each step—you’re making progress!

For more info contact me for no obligation advice.

Poll: Has your Kiwisaver taken a dip?

With the US tariffs ramping up and the stock market taking a hit, many are noticing a change in their Kiwisaver amounts.

If you've had a peek at your Kiwisaver balance since, have you seen it decrease?

-

85.2% Yes, it's decreased

-

11.6% Nope

-

3.1% Other - I'll share below

Loading…

Loading…