Using the "Bank of Mum and Dad" the Right Way

Helping Your Kids Buy a Home: Using the "Bank of Mum and Dad" the Right Way

These days, getting on the property ladder is no small feat. For many young buyers, the Bank of Mum and Dad has become a key resource. While helping your kids secure their first home can be incredibly rewarding, it’s important to approach it with care to protect your finances—and your family relationships. Here’s how to support your kids wisely and set everyone up for long-term success.

1. Start with an Open Conversation

Before diving into numbers, have a clear, honest conversation with your kids. What are their goals? How much do they need? And just as importantly, what can you realistically provide without compromising your own financial security? Open communication lays the foundation for a smooth and stress-free process.

2. Assess Your Financial Position

It’s natural to want to help, but make sure you’re not stretching yourself too thin. Look closely at your savings, retirement plans, and other financial commitments. A frank discussion with a financial advisor can help you determine how much you can offer without putting your future at risk.

3. Know the Ways You Can Help

The “Bank of Mum and Dad” isn’t just about handing over cash. You might:

- Gift a deposit: A straightforward option, but be aware of potential tax implications.

- Loan the money: If you go this route, it’s a good idea to formalise the agreement.

- Act as a guarantor: This involves using your assets to back their loan, which comes with risks.

Each option has its pros and cons, so take the time to explore what works best for everyone.

4. Get Professional Advice

Property transactions with family can be complex. Consulting a lawyer or financial advisor ensures you understand the legal and financial implications. They can help you navigate tax considerations, create formal agreements, and protect everyone’s interests. A bit of professional guidance now can save a lot of stress later.

5. Set Clear Terms and Boundaries

To avoid misunderstandings, it’s crucial to establish clear terms from the beginning. If you’re gifting money, make sure it’s understood as a gift. If it’s a loan, agree on repayment terms, timelines, and whether interest will apply. These boundaries help maintain trust and ensure everyone is on the same page.

6. Think About Long-Term Implications

While it’s wonderful to help your kids buy a home, consider how it fits into your bigger picture. Will this impact your retirement plans or other financial goals? You’ve worked hard for your security—make sure helping them doesn’t put it at risk.

7. Foster Accountability

It’s important that your kids understand the value of your support and handle it responsibly. Encouraging them to budget wisely, meet financial obligations, and stick to any agreements can help them build a strong foundation for their future.

8. Celebrate the Milestone!

Helping your kids buy their first home is a big deal, and it deserves to be celebrated. Whether it’s a family dinner or simply raising a toast, take time to enjoy this special milestone together.

The Bottom Line

As a parent, being able to help your kids buy a home is an incredible gift, but it’s one that requires thoughtful planning. By having open conversations, setting clear boundaries, and seeking professional guidance, you can provide meaningful support without jeopardising your own financial security. Done right, the Bank of Mum and Dad can be a stepping stone to their future—and a lasting investment in your family’s legacy.

Contact me for any real estate questions you and your family would like advice on. My advice is given freely and without obligation.

12 months, zero fees*

Relax, we’ve got it covered, enjoy a year of free fees*

At Ryman you won’t pay your base weekly fee for a whole year* when you sign up to an independent apartment or townhouse at a participating Ryman village before 30 June 2025.

That means that you won’t pay rates, water rates, building insurance, maintenance fees and more. That’s great financial certainty.

*Participating villages only, Ts and Cs apply

🧩 Can You Put the Pieces Together? Give It a Go! 🕶️

Give this puzzle a whirl, can you figure it out?

Do you think you know the answer? Simply 'Like' this post if you know the answer and the big reveal will be posted in the comments at 2pm on the day!

Want to stop seeing these in your newsfeed?

Head here and hover on the Following button on the top right of the page (and it will show Unfollow) and then click it. If it is giving you the option to Follow, then you've successfully unfollowed the Riddles page.

Buying a Home? Take a Breath — You’ve Got This 🏡✨

If you’ve started doing a bit of research online, chances are you’ve come across this line:

“Buying a home is one of the biggest investments you’ll ever make.”

It’s everywhere. And while it is true, it can also feel a bit... overwhelming. Like, no pressure, right?

But here’s the thing — yes, buying a home is a significant financial decision, but it’s also so much more than just numbers. You’re not just investing in property — you’re choosing a space to live your life, to create memories, to feel safe and settled. This is about building your future, not just your portfolio.

Feeling a little panicky is totally normal — but there are some simple steps that can help you move forward with confidence:

✨ Learn as much as you can about the process

✨ Get yourself prepared ahead of time

✨ Take it one step at a time — in the right order

And the best part? You don’t have to do it alone. A knowledgeable, local real estate agent (👋 hello!) can walk beside you from start to finish, helping you make sense of everything and keeping it all on track.

This is your journey — let’s make it a good one. 🏠💛

✅ Step 1: Financial Foundations

• Check your credit score

• Fix any issues on your credit report

• Start saving for:

o Deposit (usually 10–20% of the purchase price)

o Additional costs:

* LIM Report

* Builders Report

* Registered Valuation

* Lawyer’s fees

* Moving costs

• Talk to your bank and a mortgage broker

• Apply for mortgage preapproval from multiple lenders

• Compare interest rates, terms, and loan features

✅ Step 2: Define Your Dream Home

• Set your budget based on preapproval

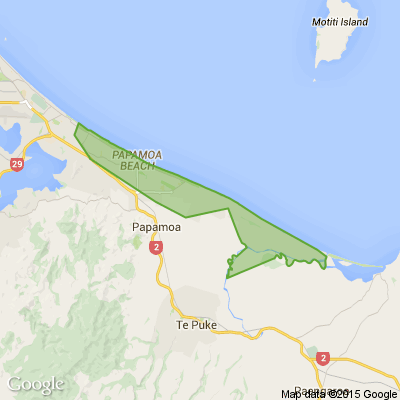

• Choose your preferred Tauranga suburbs (e.g., Bethlehem, Papamoa, The Lakes, Otumoetai, Mt Maunganui etc)

• Create a list of:

o Must-haves (e.g. 3 bedrooms, double garage, close to schools)

o Nice-to-haves (e.g. sea view, home office, big backyard)

• Prioritise your list

• Share your wishlist with your real estate agent

✅ Step 3: Choose the Right Agent

• Talk to at least two or three local agents

• Ask about their experience in your target areas

• Pay attention to:

o Communication style

o Local knowledge

o Whether they listen to your needs

o If you feel comfortable with them

✅ Step 4: Get Informed

• Ask your agent for blank copies of the forms you’ll be signing

• Learn the process of:

o Making an offer

o Conditional vs. unconditional contracts

o Settlement day

• Ask questions about anything you don’t understand

• Keep your paperwork organised

✅ Extra Tips

• Stay flexible- perfect homes rarely exist, but the right one will feel right

• Keep emotions in check during negotiations

• Don’t skip due diligence—even if the home looks great

• Celebrate each step—you’re making progress!

For more info contact me for no obligation advice.

Loading…

Loading…