EoFY 2023 Sale – 20% Off For Computers And Laptops

If you run a business or are self-employed, you know what March 31 means. It’s the end of the financial year. Time to categorize all your expenses, prepare the paperwork and decide what to do in the next financial year to make your business even more profitable!

It also means that these next few days are your last opportunity to minimize the tax you must pay. Ironically, you do it by spending money on business expenses and equipment, but if you need to buy something anyway, you might as well do it now! This way, you can claim those expenses earlier, making your tax obligations a bit smaller.

If you have been postponing getting some repairs done, upgrading your computer, or replacing it with something better, now is the time. Instead of depreciating assets over several years, the IRD allows an immediate tax deduction for equipment costing less than $1000 (GST exclusive).

That’s why we also offer 20% off all computers in stock until April 1, 2023. We have plenty of computers under $1000 in stock, so hurry up!

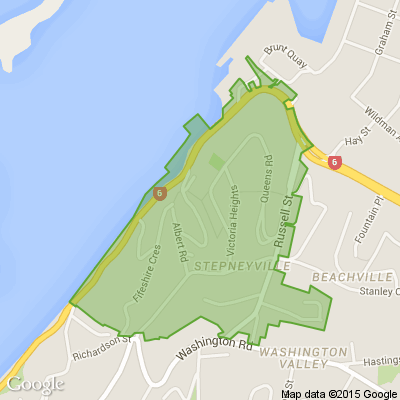

Poll: Should all neighbours have to contribute to improvements?

An Auckland court has ruled a woman doesn’t have to contribute towards the cost of fixing a driveway she shares with 10 neighbours.

When thinking about fences, driveways or tree felling, for example, do you think all neighbours should have to pay if the improvements directly benefit them?

-

82.9% Yes

-

14.4% No

-

2.7% Other - I'll share below

Poll: When should the tree go up? 🎄

From what we've heard, some Christmas trees are already being assembled and decorated.

What are your thoughts on the best time to get your Christmas tree up?

-

4.6% Second half of November

-

43.4% 1st December

-

17.7% A week before Christmas

-

33.3% Whenever you wish

-

1.1% Other - I'll share below

What's your favourite tomato recipe?

Kia ora neighbours. We know your tomato plants are still growing, but we're looking ahead to the harvest already! If you've got a family recipe for tomatoes, we'd love to see it and maybe publish it in our magazine to share with our readers. Send your recipe to mailbox@nzgardener.co.nz, and if we use it in the mag, you will receive a free copy of our February 2025 issue.

Loading…

Loading…