Should we sell or buy first?

It's a question as old as time itself-what do you do first-sell your property or buy a property? Many of us are terrified that if we sell the place we're in and we've got nowhere to go, we'll have nowhere to live.

If you have the resources to buy a new property outright-you're home and hosed. But if you don't have the available cash and you buy a place first, you have legally committed yourself meaning you may have to seek bridging finance. As a result, you could be paying interest on two properties until you sell your original home.

However, there can be a very attractive upside to buying before you sell.When you buy first you know exactly where you're moving and when. Just make sure you don't get caught out. You don't want to get into a situation where you have overestimated the value of your existing property, meaning you could be selling at a loss and end up servicing two loans!

Invite an astute local agent to give you a market appraisal on your current property and a changeover analysis on the cost to sell your existing property together with the cost to buy your new home. This information will allow you to separate the financial facts from your emotions in order to make an educated (as opposed to an emotional) decision.

If you do decide to purchase first, there are a number of things you can do to make your place easier to sell quickly. Just ensure you give yourself plenty of time to get your property ready for showcasing to potential buyers. Not many people realise that there are 137 components to listing, selling and settling a property. Typically, it takes at least two weeks of solid work to prepare a property for sale. Properties need to be tidied, cleaned de-cluttered, photos have to be taken, editorials have to be written, floor plans drawn, digital files created, legal docs approved and the signboard installed on site. Plus the ongoing preparation for open homes and weekly viewings. If you are planning on selling privately you then have the added workload of the sales process, buyer communication, legal costs to draft offers, inspections and settlement processes.

Remember, you only get one chance to make a great first impression.So it's vital to make sure your property "shines" when it is showcased on the market especially if you need it to sell quickly.

If you would like to have a chat about your options as well as an expert opinion on the "live" market value of your home please give me call on 021738769.

Kind regards,

Ben Keehan

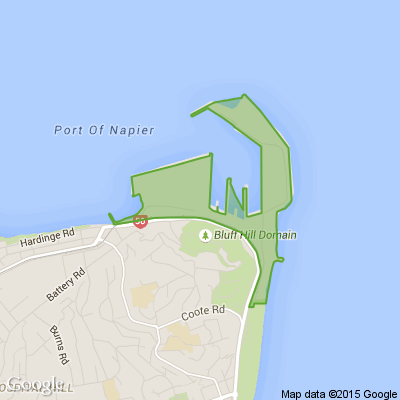

First National Hawkes Bay

What's your favourite recipe for courgettes?

Kia ora neighbours. If you've got a family recipe for courgettes, we'd love to see it and maybe publish it in our magazine. Send your recipe to mailbox@nzgardener.co.nz, and if we use it in the mag, you will receive a free copy of our January 2025 issue.

Win this brand new home!

Experience the perfect blend of country charm and city convenience in Clarks Beach, Auckland!

For just $15 a ticket, you could win this brand-new, fully furnished Jennian home, valued at over $1 million.

This home offers three bedrooms, spacious kitchen and living areas, and a double garage.

Whether you decide to make it your dream home, a holiday retreat, a rental property or simply sell it, it’s still a life-changing prize.

Don’t wait—get your tickets today at heartlottery.org.nz.

Georgina's Rhubarb Crumble

Craving a dessert that makes the most of spring's fresh produce? Look no further than Georgina's signature Rhubarb Crumble.

This delicious treat has become a favourite at Ryman’s Bert Sutcliffe Village, where the sweet and tangy aroma often wafts through the air, tempting neighbours in for a taste. It’s also a hit with Georgina's 13-year-old granddaughter, Brooklyn, who loves serving it warm with gooey custard or a scoop of melting vanilla ice cream.

Click read more for the recipe.

Loading…

Loading…