DEAR GRANT, IT'S OUR $2 BILLION YOU KNOW? - [Opinion Post of HRRA]

DEAR GRANT, IT'S OUR $2 BILLION YOU KNOW? - [Photo Credit: Stuff]

A former finance minister recently stated an old maxim -

“there is never someone more socialist than a wealthy capitalist in a time of crisis” (1 Stuff, 5th May 2020).

The Hamilton Residents and Ratepayers Association (HRRA) recently sent a letter to the Honourable Grant Robertson, Minister of Finance, expressing our concerns about our City’s processes around their proposed ‘Shovel Ready´ projects. We acknowledge the need for significant fiscal spending that is expansionary in nature given the effects of Covid-19 on our economy. Our issue is not related to the need to spend, but the process by which:

i.) projects are selected,

ii.) how that spending takes place, and

iii.) whose pockets that money ends up in.

In the context of the $2b in Hamilton City Council shovel ready projects, this looks on the face of it to be more of a lolly scramble than a measured response. We acknowledge that this process was undertaken in a rush and we now wish to ensure it becomes a transparent and measured response that will result in relieving the strain on those who will be most in need. If we are to take on significant amounts of debt on behalf of the next generation, a generation already burdened by extremely expensive housing, then it must be spent well, and spent on those who will most likely recycle that immediately back into the economy. If those ‘shovel ready’ projects involve extensive use of consultants and large machines that employ very few people and pay high prices to the asset owners, then this will just drive further inequality and disenfranchisement.

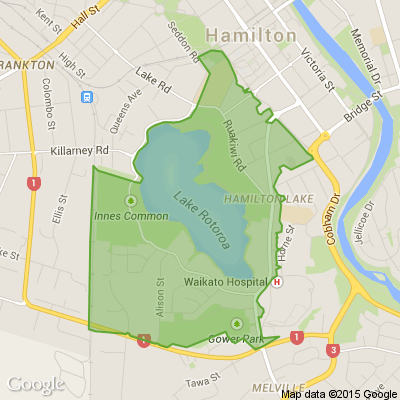

Based on the limited information we have, in Hamilton one proposal looks to be the development of sports fields with a price tag of $60 million, incorporating almost $4m in ‘professional’ fees on just four of them (2 HCC, Accessed 16th May 2020). Another is spending over $103m on gully projects (3 HCC, Accessed 16th May 2020). $103m is the equivalent of 2575 people being employed full time for a year at $40,000. The council in their proposal state this project represents 2549 employment years, yet given the amounts allocated to consultancy fees and previous experience, we are concerned about the extent to which this will eventuate? We are also extremely concerned about poor project management, as well as cost overruns which appear with startling regularity in council projects throughout the country (4 RNZ, 2nd May 2019; 5 Stuff, 19th May 2019; 6 Stuff, 15 Mar 2020; 7 Stuff, 15th May 2020). Sadly, we are also seeing individuals and organisations apparently exploiting the current crisis for their own benefit (8 Stuff 24th Apr 2020; 9 Stuff 15th May 2020). With such massive intergenerational debt being proposed, it is crucial that this money is spent well, and that those that exploit the situation for their own greed are held to account.

To avoid these issues, we want to ensure that systems are put in place to ensure that any money is actually well spent in a transparent way; and that officials are held accountable if it is not. $2b represents, in shovel ready terms, 50,000 people being employed at $40,000 for a year. This in a city of just 60,000 ratepayers. Of course, there are significant materials costs for many of these projects, but it is important in our view;

i) the majority of this spend goes to those who will soon become unemployed, with a focus on local individuals and companies,

ii) that this money comes with comprehensive and fully transparent cost/benefit analyses, that are fully audited by independent groups; including ratepayer groups,

iii) that contract selection and negotiation processes are transparent and involve interested ratepayer groups in the decision,

iv) that penalties apply if deadlines are not met, that price overruns are covered by any contractor for external projects, and a significant amount of any payment is not paid out until after completion,

v) once initiated that comprehensive project cost tracking systems and rigorous systems of financial review are put in place and any evidence of fraud or other immoral activity results in the most stringent penalties – both civil and criminal,

vi) officials in charge of these projects are held to account for failure.

Unfortunately, given the recent history of council projects, the V8’s, Claudelands Showgrounds, Claudelands bridge, Peacocke - SH3 Roundabout to name but a few, we have little reason to be confident in council’s ability to manage projects, or the Council’s stated projections.

The other issue is the amount of the spend. There is some concern in the community that rather than focused on core council areas that badly need investment, that they represent an opportunistic money grab. We must ensure that the amounts spent on these projects reflect a prudent long-term investment of taxpayer’s money. What is the projected timeframe for a return on an investment on the Gully project of $103 million? While there will be a range of environmental and wellbeing benefits attached, how can we justify a spend of $103m when presumably there are significant fall off in marginal returns over a price tag of what might be a few million? In difficult economic times comprehensive cost/benefit analyses which show the diminishing rates of return across different spending allocations is needed. There are numerous projects that surely have a higher long-term economic, environmental and wellbeing return that would be accounted for in at least a significant portion of this spend? We do not want to rush into a few mega projects that are poor investment decisions when all or part of that funding would provide a much higher benefit to the current and future generations that will be paying for it if spent elsewhere.

$2b of debt represents a burden in the context of Hamilton of over $33,000 per ratepayer. A burden which if it were council debt would be held over our homes. In this case it will be held over the homes of NZ’s future generations. Again, in these unprecedented times we agree that fiscal spending is required, all we ask is that this spending goes to those most in need, and on projects that reflect a good investment in our community. We also implore that such massive expenditures are scrutinized and carried out in a manner that is fully transparent and that there is accountability. After all – We All Want to Avoid Lolly Scramble Don’t We?...

1www.stuff.co.nz...

2www.hamilton.govt.nz...

3www.hamilton.govt.nz...

4www.rnz.co.nz...

5www.stuff.co.nz...

Choose Your Class and Start Your Creative Journey!

Build new skills, have fun, and gain a unique creative experience in a supportive environment.

📅 Don’t wait – book your spot today!

👉 www.artsforhealth.co.nz...

We're talking new year resolutions...

Tidying the house before going to bed each night, meditating upon waking or taking the stairs at work.

What’s something quick, or easy, that you started doing that made a major positive change in your life?

Riddles to Resolve Your Resolution!

I shave every day, but my beard stays the same.

What am I?

Do you think you know the answer to our daily riddle? Don't spoil it for your neighbours! Simply 'Like' this post and we'll post the answer in the comments below at 2pm.

Want to stop seeing riddles in your newsfeed?

Head here and hover on the Following button on the top right of the page (and it will show Unfollow) and then click it. If it is giving you the option to Follow, then you've successfully unfollowed the Riddles page.

Loading…

Loading…