Regional council ECan proposes hefty rate rises

By reporter Keiller MacDuff:

Environment Canterbury (ECan) floated one of the largest proposed average rates rises in the country on Wednesday - more than 24% - a day after the Christchurch City Council adopted a draft proposal for a 13% rates rise.

Councils nationwide are proposing significant rises as interest rates bite and increasing severe weather calls for more resilience work.

ECan councillors voted 14:2 to adopt the consultation document for its long-term plan (LTP), which outlines the council's activities, services and finances for the next decade, with councillors Clair McKay and Deon Swiggs voting against the recommendation.

The plan will see ECan spend more than $340 million in the first year, a 26% increase on the $270m programme carried out in 2023-24.

The draft says the council gave “strong consideration“ to the financial pressures the community is facing, but previous decisions on flood management and public transport combined with high inflation meant just maintaining current work required a double digit increase.

The actual rating impact will differ depending on location and targeted rates, meaning the increase will be between 13% and 27%.

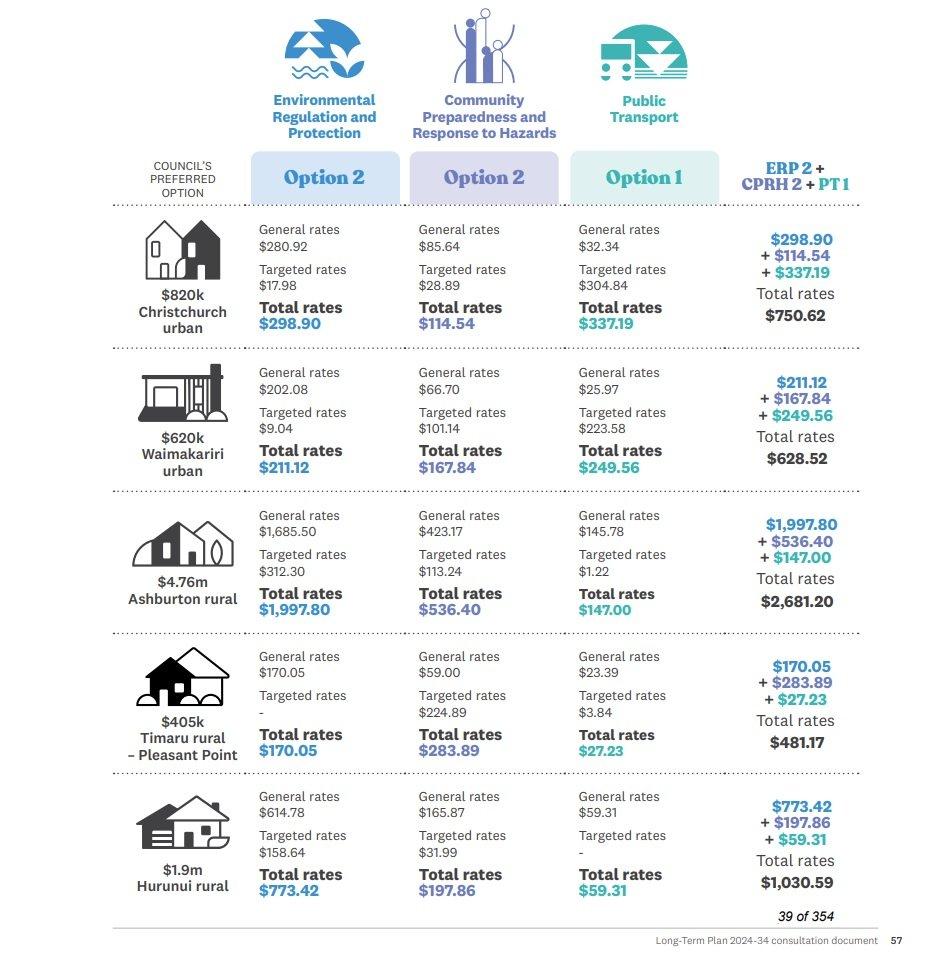

If the regional council’s preferred options are adopted, a Christchurch city ratepayer with a $820,000 property would pay $750 in the first year of the plan, while a $1.9m rural property in Hurunui faced a $1030 rates bill for 2024-25, and a $4.76m rural Ashburton property would pay $2681 in rates.

Of ECan's three core services - environmental regulation and protection, hazard preparedness and response, and public transport - the latter has the biggest cost.

The council’s preferred public transport option has a $160m price tag for the first year (a total of $542m over three years) and would see the Public Transport Futures programme improvements delivered within seven years, including upping core bus routes to ten minute frequencies or better by 2028, with average wait times of five minutes.

It also includes:

- More direct services to parts of Waimakariri and Selwyn, starting in 2026-27.

- A review of connector and local services by mid-2026, with improvements implemented by 2031.

- An additional Diamond Harbour ferry and refurbishment of the existing ferry.

- Improvements to the network, such as increasing capacity on crowded buses and small tweaks to routes or frequency

- Enhanced safety improvements, increased investment in reliability and the continued replacement of end-of-life diesel buses with new electric buses.

The option also includes funding to “explore opportunities” to improve transport to and from Te Kaha, on demand services in Greater Christchurch, and - long term - looking at asset ownership.

The document notes the region has “historically under-invested in public transport,” leading to low usage, and proposes “considerable investment.” But both the regional council and the auditor, whose report was also tabled, drew attention to the “high level of uncertainty” surrounding the government’s contribution.

The council’s preferred option for environmental regulation and protection would cost $135m for the LTP’s first year, and could sit alongside a targeted rate for additional biodiversity work in Christchurch and Banks Peninsula.

The separate biodiversity rate works out at 72 cents per $100,000 capital value of rateable properties.

ECan’s preferred option for community preparedness and hazard response - $50.5m - includes a targeted rate for Selwyn residents for district-wide flood and river resilience work.

The targeted rate would cost $7.08 per rate paying property in the first year, $10.62 in the second year, and $14.16 in the third year, raising $400,000 in 2026-27.

Most councillors expressed misgivings about the scale of the proposed rise, but backed the document through the consultation process.

McKay accused her fellow councillors of being “tone deaf”, and asked what right the council had “to treat our ratepayers as an ATM machine?”

She criticised the amount of borrowing and said she was “embarrassed to be associated” with the amount council sought.

Swiggs also expressed misgivings about debt funding, and criticised the local government funding model in general.

“Imagine if Wellington had to budget the way we have to,” Swiggs said, commenting on the discrepency in tax take between central and local government,.

On Tuesday, the Christchurch City Council voted 13 to 4 in favour of a draft long-term plan that proposes an average rates increase of 13.24% from June, followed by 7.76% in the following financial year, and 4.67% the year after.

Consultation on ECan’s draft LTP will run from mid-March to mid-April, with hearings scheduled for the end of April and early May. The council is scheduled to deliberate at the end of May with a view to adopt the plan and set rates in late June.

Best way to use leftovers?

I'm sure you've got some excess ham at home or cold roast potatoes.

What are some of your favourite ways to use leftover food from Christmas day? Share below.

⚠️ DOGS DIE IN HOT CARS. If you love them, don't leave them. ⚠️

It's a message we share time and time again, and this year, we're calling on you to help us spread that message further.

Did you know that calls to SPCA about dogs left inside hot cars made up a whopping 11% of all welfare calls last summer? This is a completely preventable issue, and one which is causing hundreds of dogs (often loved pets) to suffer.

Here are some quick facts to share with the dog owners in your life:

👉 The temperature inside a car can heat to over 50°C in less than 15 minutes.

👉 Parking in the shade and cracking windows does little to help on a warm day. Dogs rely on panting to keep cool, which they can't do in a hot car.

👉 This puts dogs at a high risk of heatstroke - a serious condition for dogs, with a mortality rate between 39%-50%.

👉 It is an offence under the Animal Welfare Act to leave a dog in a hot vehicle if they are showing signs of heat stress. You can be fined, and prosecuted.

SPCA has created downloadable resources to help you spread the message even further. Posters, a flyer, and a social media tile can be downloaded from our website here: www.spca.nz...

We encourage you to use these - and ask your local businesses to display the posters if they can. Flyers can be kept in your car and handed out as needed.

This is a community problem, and one we cannot solve alone. Help us to prevent more tragedies this summer by sharing this post.

On behalf of the animals - thank you ❤️

Loading…

Loading…