Poll: Do you like this new art work?

Local artists and tertiary art students have collaborated to create a new piece of large-scale art that celebrates the cultural diversity of Tāmaki Makaurau.

Students Nikita Sharma, Celia Lee and Jenny Zhong were chosen to design and paint one panel of the three-section mural after an invitation by Study Auckland.

The goal was to give international students the chance to work with renound artists Ross Liew, Hana Maihi of Ngati Whatua Orakei and Te Whetu Collective member Poi Ngawati and experience crafting public art.

The other two panels have been painted by Maihi and Ngawati to create awareness of the rich Māori heritage on which the city was founded.

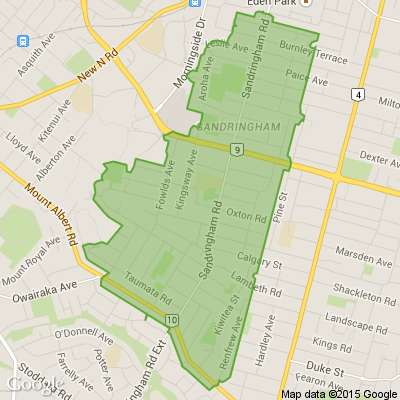

The three panels depict the importance of welcoming different cultures in Tamaki Makaurau and Te Tōangaroa, an area spanning from the end of Britomart to The Strand.

The biodiversity that once characterised the cultural landscape of Te Tōangaroa and Ngāti Whātua Ōrākei’s history as mana whenua of Tāmaki have also been highlighted in the mural design.

Ngāti Whātua Ōrākei Whai Rawa cultural design executive Mei Hill said other Ngāti Whātua Ōrākei initiatives were planned to reinvigorate the cultural footprint of Te Tōangaroa.

“Sharing the journey of Ngāti Whātua Ōrākei through art is just the beginning of how we intend to bring to life the masterplan for Te Tōangaroa. Our vision is a space where the people of Tāmaki can come together and enjoy and respect the culture and environment this city and its people have to offer,” Hill said.

*Please put NFP if you do not want your comments used by Stuff.

*To see a timelapse video of the mural being created from scratch, go here:

drive.google.com...

-

80.9% Yes

-

17.6% No

-

1.5% Unsure- it's too complex

Christmas Trees

Taking orders now for delivery or click and collect. Opening on Friday 22 November - 7 Days 9am to 6.30pm. Balmoral Road/Tenterden Ave Corner. Beautiful fresh fragrant Christmas Trees, Tree stands, local delivery service & Recycle pick up Service.

Retire in comfort and security

Premium care just meters away form our village. Join our caring community, where passion thrives. Trust Terrace Kennedy House for exceptional care and meaningful connections.

It’s Riddle Time – You Might Need an Extra Cup of Coffee!

Nobody has ever walked this way. Which way is it?

Do you think you know the answer to our daily riddle? Don't spoil it for your neighbours! Simply 'Like' this post and we'll post the answer in the comments below at 2pm.

Want to stop seeing riddles in your newsfeed?

Head here and hover on the Following button on the top right of the page (and it will show Unfollow) and then click it. If it is giving you the option to Follow, then you've successfully unfollowed the Riddles page.

Loading…

Loading…