JULY--1st----Today's changes that could affect your bank account

The start of July brings a raft of changes that will affect households across the country.

From prescription changes to mortgage tweaks, the rules, fees and taxes will affect the way that many people spend and borrow money.

Here are a few of them.

===================

Debt-to-income ratios and loan-to-value restriction tweaks

==============================================

New debt-to-income rules will limit how much banks can lend to borrowers, compared to their household income.

Only 20 percent of lending can go to owner-occupier buyers with a debt-to-income ratio of six, and only 20 percent of investors loans will be able to be at a debt-to-income ratio of more than seven.

The debt-to-income calculation takes into account other debt, such as student loans.

These rules are not expected to make a big difference initially, because not much lending is currently being done above those levels. However, they are likely to limit the extent of future house price growth.

At the same time, loan-to-value rules will be eased slightly to allow banks to give 20 percent of lending to owner-occupier borrowers with a deposit or equity of less than 20 percent, and 5 percent of lending to investors with a deposit or equity of less than 30 per cent.

Previously, they could only lend 15 percent to owner-occupiers with less than 20 percent deposit and 5 percent of lending to investors with less than 35 percent.

Prescription charges

=================

A $5 charge is coming back on for prescriptions.

This does not apply to people who are over 65, Community Services Card holders, people who are under 14 or people ages 14 to 17 who are dependent on a Community Services Cardholder.

Auckland regional fuel tax abolished

==============================

The Auckland Regional Fuel Tax scheme ended on 30 June.

This is worth 11.5c per litre on petrol, diesel and their biovariants.

FamilyBoost introduced

===================

The FamilyBoost policy takes effect from 1 July, offering a payment of 25 percent of early childhood education fees for households up to $75 a week.

This is available in full to households earning up to $140,000 and reduces for those earning up to $170,000.

Households should start saving their invoices from 1 July as either PDF or JPG files, Inland Revenue says.

Payments will be made in three-monthly blocks, starting in October.

Bright-line test reduced

===================

From 1 July, the bright-line test will reduce to two years, from the current 10 years, or five for new builds.

The bright-line test sets a limit on how long properties, apart from someone's main home, have to be held to avoid tax on capital gains when they are sold.

That means that properties sold on or after Monday now need to have been held for at least two years to avoid the automatic tax.

Chartered Accountants Australia and New Zealand is warning there could be some confusion, though, because the new rules focus on the "disposal" date of a property rather than the acquisition date.

"Care needs to be taken as the dates are determined differently. The bright-line end date is determined by when the seller first enters a contract for sale, whereas the start, or acquisition date is typically determined when title transfers."

He said that could mean that anyone who had entered negotiations before 1 July could still be captured under the old rule.

Paid parental leave increases

========================

Each year, the maximum amount of paid parental leave available increases.

How much you get is determined by how much you were earning before you went on leave.

From 1 July, the maximum is $754.87 a week before tax, compared to $712.17 previously.

Gaming duty for offshore operators

=============================

From 1 July, a 12 percent offshore gambling duty applies operators who are taking bets from New Zealand residents.

Offshore gambling operators have to register for GST if they make more than $60,000 in a 120-month period. Those that are registered for GST must also now register for the duty.

Excise tax on alcohol increases

The annual adjustment of excise tax on alcohol takes place on 1 July. This is based on movements in the consumer price index in the year to March.

=================================================

www.newshub.co.nz....

==================================================

Poll: Should all neighbours have to contribute to improvements?

An Auckland court has ruled a woman doesn’t have to contribute towards the cost of fixing a driveway she shares with 10 neighbours.

When thinking about fences, driveways or tree felling, for example, do you think all neighbours should have to pay if the improvements directly benefit them?

-

81.3% Yes

-

16% No

-

2.7% Other - I'll share below

Persistence and Attention to Detail (Day 7)

In the serene village of Te Ao Marama, a young Māori student named Aroha was studying engineering at a renowned university in Aotearoa (New Zealand). Aroha was a dedicated learner, carrying with her the aspirations of her whānau (family) and iwi (tribe). She approached her studies with the same principles her tūpuna (ancestors) had lived by: manaakitanga (care and respect for others), kaitiakitanga (guardianship), and a commitment to excellence.

Aroha had consistently achieved high marks in her studies, always earning recognition for her hard work. But when her third-year semester results were published, Aroha was disheartened to see her grades fall to a whakamanawa noa (average pass). One course, in particular, had received unusually low marks, and she couldn’t understand why.

Instead of reacting in frustration, Aroha reflected on the teachings of her kaumātua (elders): "Kia mau ki te tūmanako” — hold on to hope. She sought advice from her peers, who told her to let it go and move forward. They warned her that challenging the system could be risky and might even result in worse outcomes.

Aroha, however, trusted her instincts. She remembered how her tupuna would pause to think carefully before making important decisions. She went to the local marae for karakia (prayer) and spent time in quiet contemplation, asking for guidance. While reflecting, she recalled that during the exam, she had used extra paper to explain her calculations. A thought struck her: what if the additional pages hadn’t been reviewed?

With renewed determination, Aroha submitted a formal request for a recount (re - totaling of her marks). She included a note explaining that she had attached extra pages and asked the examiners to check whether they had been accounted for.

When the recount results came back, her suspicion proved correct—the additional pages containing key parts of her answers had been overlooked. Her recalculated score not only restored her distinction but also placed her among the top students in her class.

Aroha shared the news with her whānau, who celebrated her perseverance. But she also took a moment to thank her professors for their work and acknowledge the importance of the process.

Moral of the Story

This story reflects the principles of whakamanawa (perseverance) and aro nui (attention to detail). Aroha’s success came not only from her hard work but from her willingness to trust her instincts, reflect thoughtfully, and act with respect for the academic system.

Her journey also highlights manaakitanga—the importance of showing gratitude and care for others, even when seeking justice for oneself. For Aroha, her achievement was not just a personal victory but a way to honour her tūpuna and demonstrate how Māori values can guide success in all aspects of life.

Ridiculous Fuel Pricing!

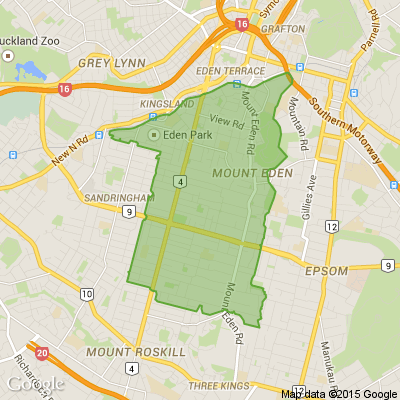

I opted to drive down 5kms to Waitomo Epsom, where fuel prices are lower compared to anywhere in Mount Roskill. On a full fuel tank of about 40 liters, you'll save around $8.5 overall, and this is without any discounts at Waitomo. Mobile Epsom is still cheaper, and the savings would have been $12 or more.

This math of pump pricing is beyond me as the source/starting point of the tankers is more or less the same and the suburbs aren't that far away 🤔.

Loading…

Loading…