Coronavirus financial package: Government's $12b support plan for businesses, beneficiaries

The Government has unveiled a $12.1 billion support package for the New Zealand economy, with almost half of the cash to be spent on a wage subsidy package for all coronavirus-impacted businesses. Those full-time workers eligible for the package will receive $585 per week from the Government, paid in a lump sum package of just over $7000 covering a 12-week period. The Government is also raising benefits by $25 a week, starting April 1, and doubling the Winter Energy Payment. This is just the first tranche of the Government spending response – the rest will be unveiled during May's "recovery" Budget. Today's package comes as part of "the most significant peace-time economic plan in modern New Zealand history. The $12.1 billion spending package accounts for roughly 4 per cent of New Zealand's GDP and is comparatively bigger than the relief packages so far announced by Australia, the UK and the US. "The Government is pulling out all the stops to protect the health of New Zealanders and the health of our economy," Prime Minister Jacinda Ardern said. The big-ticket items of the package include $5.1 billion for the wage subsidy package, $2.8b for benefit increases and the bolstered Winter Energy Payment and a further $2.8b for tax changes to free up cash flow. That's a total of $8.7 billion for businesses and jobs. The package also contains an initial $500 million boost in health spending and an initial $600 million to support the aviation sector. A Covid-19 sick leave scheme has also been created and will be available for eight weeks at a cost of $126.5 million.

Some 27,000 workers every two weeks are expected to take advantage of this scheme. Finance Minister Grant Robertson said the package is one of the largest in the world on a per capita basis. It is more than the total sum of new spending in all three of the last Budgets put together.

"The global economic impact of Covid-19 on New Zealand's economy is going to be significant, so we are acting now to soften the impact." But Robertson is forecasting the Government to be in deficit for the foreseeable future and will have to borrow billions of dollars to fund the spending package. "This is the rainy day we have been planning for." The flagship element of the Government's package – the wage subsidy package – is for any employer which has suffered, or is projected to suffer, a 30 per cent decline in revenue compared to any months between January and June the year prior. But to be eligible employers must have taken active steps to mitigate the impact of Covid-19, for example engaging with their banks or financial advisors. Employers also need to declare that they will continue to employ affected employees at a minimum of 80 per cent of their income over the 12 months period.

Some $585.80 a week will be available for full-time workers (20 hours a week or more) or $350 a week for part-time workers (20 hours or fewer a week. The maximum amount any one employer can receive is $150,000. Employers are encouraged to apply for the subsidies – which will be made available today – as soon as possible. "We're going hard with our health response," Ardern said, "and now we're going hard with our financial assistance".

Who's eligible for wage subsidies?

============================

A six-person forestry contracting business in Gisborne whose revenue is down 90 per cent as a result of Covid-19, for example, will be eligible. The employer would get a lump sum of $42,117 for to pay their employees for 12 weeks.

How does the Covid-19 sick leave work?

==================================

The Government will cover the cost of sick leave for those who have already used their mandatory sick leave and who are not able to work from home. Employers apply to the Ministry of Social Development for a lump sum to help cover the cost.

What are the details of the benefit increase?=====================================

In addition to the $25 a week increase, working for families with children who are not receiving a main benefit and have some level of employment income each week will no longer have to satisfy the hours test to receive the In Work Tax Credit. The benefit increases will come into effect automatically. The Winter Energy Payment will increase to $40.91 per week for single people and $63.64 per week for couples and people with dependents – this increase is for 2020 only.

=======================================================

Poll: Is it rude to talk on the phone on a bus?

Buses can be a relaxing way to get home if you have a seat and enough space. However, it can be off-putting when someone is taking a phone call next to you.

Do you think it's inconsiderate for people to have lengthy phone calls on a bus? Vote in the poll, and add your comments below.

-

64% Yes

-

33.7% No

-

2.3% Other - I'll share below

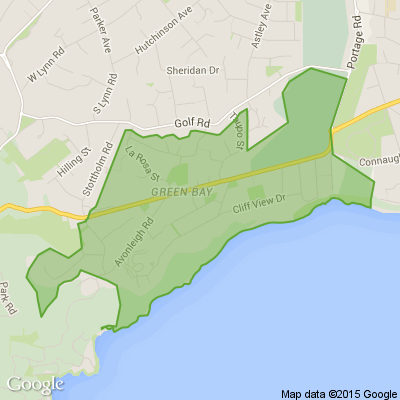

BLOCKHOUSE BAY MARKET

COME AND JOIN US AT BLOCKHOUSE BAY MARKET, SUPPORT YOUR LOCAL COMMUNITY, BUY NZ MADE, FIND A BARGAIN, PLEASE BRING CASH AS MOST VENDORS DI NOT HAVE EFTPOS OR SUCH. FREE PARKING OPPOSITE AT MEDICAL CENTRE OR BEHIND COMMUNITY CENTRE!

Become an SPCA Foster Hero!

Kitten season has arrived, and over the next six months, over 8,000 cats and kittens will come into SPCA’s care. Please help us give these babies the best start in life and sign up to be a foster parent today! It's not just cats and kittens - we are also urgently seeking foster homes for dogs and small animals.

Fostering saves lives and helps these tiny babies grow into healthy, well-adjusted adults, ready for adoption. We cover all training and costs. All you need is time and love to spare!

Sign up today and save a life!

Loading…

Loading…