Are you a first home buyer?

Auctions are coming back, there is an increase in the clearance rate compared to several months ago, as more bidders are returning to the auction rooms.

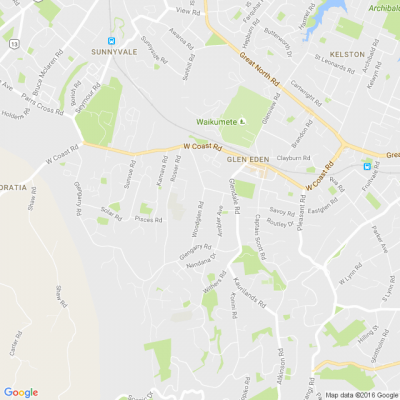

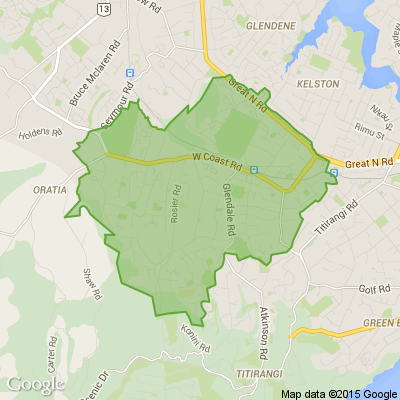

As a first home buyer, you would have invested your time on the weekend for open homes, and doing your due diligence, a pathway to secure your own home.

There have been situations whereby prospective buyers have participated in auctions. However, prior to engaging in auctions, they already had pre-approvals from two different lenders with varying lending limits. This action has significantly boosted the prospective buyer’s chances, thereby being well prepared ahead of the auction day.

1. Every lender has different credit appetite, which is constantly changing.

2. To keep a track of the lenders, and banking world, it can be overwhelming for prospective buyers, hence as a financial adviser we want to assist with your journey and make the buying process smooth.

3. Added benefit of financial advice, to ensure your loan is not only approved, but loan has been structured correctly and suits your financial objective.

Are you ready to bid on your next home?

Poll: Are our Kiwi summer holidays helping us recharge, or holding the economy back? ☀️🥝

There’s growing debate about whether New Zealand’s extended Christmas break (and the slowdown that comes with it) affects productivity.

Tracy Watkins has weighed in ... now it’s your turn. What’s your take? 🤔

-

72% We work hard, we deserve a break!

-

16.3% Hmm, maybe?

-

11.7% Yes!

Some Choice News!

Many New Zealand gardens aren’t seeing as many monarch butterflies fluttering around their swan plants and flower beds these days — the hungry Asian paper wasp has been taking its toll.

Thanks to people like Alan Baldick, who’s made it his mission to protect the monarch, his neighbours still get to enjoy these beautiful butterflies in their own backyards.

Thinking about planting something to invite more butterflies, bees, and birds into your garden?

Thanks for your mahi, Alan! We hope this brings a smile!

Your Christmas shopping just got easier

Mags4gifts.co.nz is having a Christmas sale with up to 40% off best-selling magazine subscriptions, including NZ Gardener, NZ House & Garden and TV Guide. Add a free e-card at checkout and schedule it to arrive on Christmas morning for a perfectly timed surprise! Make Christmas thoughtful this year with a gift that lasts long after the holidays are over.

Loading…

Loading…