Kids Christmas Eve

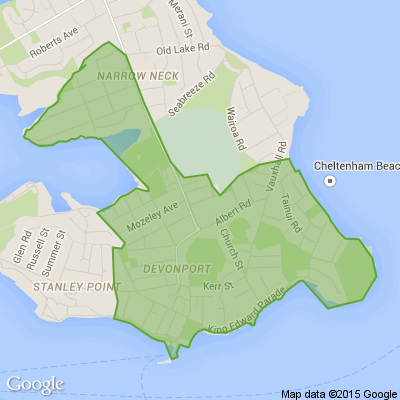

Join us at Devonport Methodist for a special Kids' Christmas Eve celebration.

Perfect for preschool and primary-aged kids and their families, in the garden at the back of Devonport Methodist Church.

Come on an adventure to get ready for Christmas and find the Baby. And join us for a sausage sizzle at the end.

18 Owens Road, Devonport

Poll: Has your Kiwisaver taken a dip?

With the US tariffs ramping up and the stock market taking a hit, many are noticing a change in their Kiwisaver amounts.

If you've had a peek at your Kiwisaver balance since, have you seen it decrease?

-

85.3% Yes, it's decreased

-

11.4% Nope

-

3.2% Other - I'll share below

Auckland CVs Delayed Again – What You Need to Know

Auckland Council has confirmed that its three-yearly property revaluations — originally expected in late 2024 — have now been further delayed, with values now due “sometime in 2025.”

This impacts homeowners, buyers, investors, and even lenders who often rely on updated CVs (Capital Values) as part of property assessments.

Auckland Council and the Valuer-General cite the need for additional audit work to ensure valuations accurately reflect the market as at 1 May 2024. While that diligence is welcome, the lack of a firm timeline is creating uncertainty across the property and lending sectors.

Why this matters:

🔹 Banks may need to rely more on registered valuations or recent comparable sales when assessing lending.

🔹Agents and buyers may see more inconsistent price signals, especially in emerging or fluctuating suburbs.

🔹Refinancing and equity release options could be impacted if you're banking on a value uplift.

If you're planning a move — whether it's a refinance, restructure, or new purchase — it’s even more important to get independent advice right now.

At adviceHQ , we’re helping clients navigate around the missing CVs by working directly with lenders and valuers to get the numbers that matter.

Reach out if you want clarity on what this means for your plans.

#AucklandProperty #CapitalValues #Refinancing #HomeLoans #adviceHQ

Scam alert - ASB users 🚨

ASB bank have shared a message to make people aware that messages from scammers claiming they are from our ASB Securities team are doing the rounds.

If you receive one of these messages don’t act on it, don’t click on any links on suspicious emails and text messages, or provide any personal or banking information.

If you think you’ve provided your details to a suspicious person or company, please call your bank immediately.

ASB are available 24/7 on 0800 ASB FRAUD (0800 272 372), or +64 9 303 0332 if you're overseas.

For ASB users, if you want some more info on staying safe online visit asb.co.nz/asbscamhub

Loading…

Loading…