How to estimate the rental return on an investment property

No matter what investment strategy you use, calculating the potential rental return on an investment property is a key step in the purchasing decision process. The rental yield is an important indicator of how a property is likely to perform and the cash flow it will generate. So, whether you’re using a positive or negative gearing strategy, it’s a calculation that allows you to quickly decide if the numbers will stack up for you, and if you can afford to service a loan on a particular property.

In this article, we explain how to estimate the rental yield – an important first step before deciding whether an investment property is the right one for you. It should be noted that this is a general guide only – you should consult me before proceeding with any investment or tax strategy.

So, what exactly is rental yield?

When buying an investment property, investors typically consider two key factors. Capital growth, or how much a property is likely to increase in value over time, and rental yield.

The rental yield is the rental income of a property, expressed as a percentage of its value. It can be calculated in gross terms (before expenses), or as a net percentage (with expenses factored in).

* Gross rental yield = (Annual rental income / Property value) x 100

Example: A property with a market value of $500,000 that returns a weekly rent of $500, or $26,000 a year ($500 x 52), would have a potential gross rental yield of:

($26,000/ $500,000) x 100 = 5.2%.

Sometimes gross rental yields are calculated as a percentage of the original purchase price, rather than the market value. This can affect the outcome. For example, if you used an original purchase price of $400,000 in the example above, the gross rental yield would be 6.5%.

Overall, the gross rental yield offers a simple way to compare properties quickly. It gives you an overview of how the rental income compares to the value of the property and how likely it is to generate a positive or negative cash flow.

However, it does not take expenses into consideration. For that reason, a lot of investors use the net rental yield as a more accurate way of assessing returns.

* Net rental yield = [(Annual rental income – Annual expenses) / Total property cost] x 100

The net rental yield offers a clearer indication of whether you can afford an investment property, as it factors in your expenses. To work it out, you’ll need to calculate or estimate your total property costs and total annual expenses.

Total property costs could include:

• The purchase price/ market value

• Stamp duty (not yet in NZ)

• Conveyancing fees

• Building and pest inspections

• Loan establishment fees

Total annual expenses may include:

• Property management fees

• Rates and water charges

• Strata levies (if applicable)

• Insurance

• Mortgage interest repayments.

Example: A property with a weekly rent of $500 ($26,000 a year), total property costs of $500,000 and annual expenses of $25,000 would have a net rental yield of:

= [($26,000 – $25,000)/ $500,000] x 100 = 0.2%.

Calculating the net rental yield can be tricky, given you need to understand the costs of buying and running an investment property. If you’re stuck, please get in touch with me to help you crunch the numbers.

Yields versus capital growth

While strong rental yields are great, it’s important to remember that they’re not necessarily the be all and end all of a property investment. Some investors opt for a lower yield but focus on buying property that is likely to experience capital growth. It all comes down to your investment strategy and goals.

Investing in property opens up opportunities to build long-term wealth, potentially benefit from a positive cash flow and/or reap certain tax benefits please contact me to understand how you can obtain the tax benefits).

If you’re considering an investment property purchase, I can assist with arranging the right mortgage broker to give you advice on the finance option to suit your investment strategy and goals. That includes everything from calculating your borrowing power to finding you a competitive investment loan for your needs. Please get in touch and let’s make it happen.

Disclaimer

This article provides general information only and has been prepared without taking into account your objectives, financial situation or needs. We recommend that you consider whether it is appropriate for your circumstances and your full financial situation will need to be reviewed prior to acceptance of any offer or product. It does not constitute legal, tax or financial advice and you should always seek professional advice in relation to your individual circumstances. Subject to lenders terms and conditions, fees and charges and eligibility criteria apply.

Baptist Lobo CA, CPA

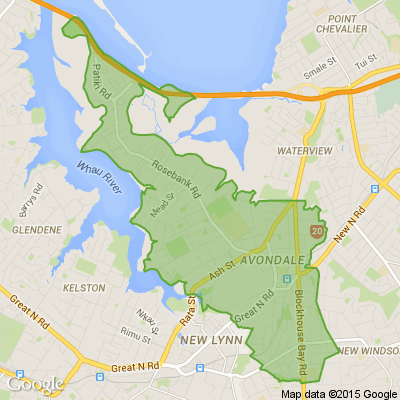

63 Shoreham Street

New Windsor

Auckland 0600

Mobile # +64 21 815040

Home # +64 9 8287877

Poll: When should the tree go up? 🎄

From what we've heard, some Christmas trees are already being assembled and decorated.

What are your thoughts on the best time to get your Christmas tree up?

-

3.7% Second half of November

-

41.1% 1st December

-

17.1% A week before Christmas

-

36.9% Whenever you wish

-

1.2% Other - I'll share below

Don’t Wash Your Hair In The Shower

It’s so good to finally get a “Health Warning” that is useful.

It involves the shampoo when it runs down your body when you shower with it… a warning to us all!”

I don’t know why I didn’t figure this out sooner!

I use shampoo in the shower when I wash my hair.

The shampoo runs down my whole body and printed very clearly on the shampoo label is this warning: “For Extra Body & Volume”

No wonder I have been gaining weight!

Well I got rid of that shampoo.

I am going to start showering with Dawn dishwashing Soap instead.

The label reads: “Dissolves Fat” that is otherwise difficult to remove.

Problem Solved✅

Riddle Me This, Neighbours! Bet You Can’t Guess It!

Sometimes narrow, sometimes wide, wind or rain, I stay outside.

Even if there’s heat or snow, from house to house I will still go.

What am I?

Do you think you know the answer to our daily riddle? Don't spoil it for your neighbours! Simply 'Like' this post and we'll post the answer in the comments below at 2pm.

Want to stop seeing riddles in your newsfeed?

Head here and hover on the Following button on the top right of the page (and it will show Unfollow) and then click it. If it is giving you the option to Follow, then you've successfully unfollowed the Riddles page.

Loading…

Loading…