Being smart with your mortgage and saving lots in interest!

Sometimes life can work out better than expected. Going back a few years I would not have predicted that I would be working in a job that I really loved!!

I started my early career in banking and finance and did the whole 8-5pm thing for many years. In my later years as I moved along the corporate ladder I even got to do the 7am to 7pm and beyond thing. ☹ ☹

The biggest issue for me was that I wanted to buy a home for myself and my daughter. I found paying rent every month frustrating. I didn’t want to be paying off someone else’s mortgage when I could just as easily be paying off my own. I know everyone has to pay rent for a period in their lives but I thought it was just an expense, so why couldn’t I make it my own expense and get the benefit of paying my own rent to myself!!!

This went on for far longer than it should, as I worked, raised my daughter and juggled the costs of childcare, rent, insurance, living expenses etc. It certainly wasn’t easy. So I saved every dollar I could and after a time and with a few sacrifices (wine, dinners out, wine, holidays, wine) I was able to get a deposit together.

In the first instance, I was just so happy that my loan had been approved and that I would actually be able to move into my own home. 😊 😊 My mortgage was over 30 years which seemed fine with me. It took me quite a while to figure out that I actually needed to manage my mortgage rather than just go along with what the lender told me. I realised that paying even just a little more each week made such a huge difference to the amount of interest I would pay over the term of the loan AND it also reduced my loan term which meant I was paying off my loan faster!! Yayyy.

When I did the calculations I was amazed to see the amount of interest I was saving over the term of the loan – it was over $100,000 thousand dollars! I didn’t even have to stay in the same house to do this! I could also trade up and achieve the same savings.

So, because I learnt this knowledge on the job as it were, I could apply it to my own situation and it allowed me to create more financial freedom for myself.

Fortunately, a few years ago, I and realised that life was passing by quickly and it was time for me to get real and do a job where I could really make a difference and help people on a one to one basis. I think my volunteer work as a Business Mentor helped me to understand that this is where my skill set lay and I get a real buzz from seeing people develop themselves and their financial wellbeing.

During this time, the people I met all had mortgages and families, some with or without children and it became really clear to me that there was a huge knowledge gap about the process of how to get a mortgage and perhaps more importantly, how to repay it!! So …………. ”light bulb moment” I decided to do the study to become a mortgage adviser and become self-employed!

Like all things in life, the more you do things the more confident and adept you become even if it can be complicated. However, for most of us, getting a mortgage is not something we do every day and because the outcome can really impact on ourselves and our families, it can be downright nerve-racking. Also, we are usually very emotionally invested in the process never mind trying to balance it with our usual work and family commitments!

Despite limited media coverage, the fact is for the year ended June 2018, 34,343 First Home Buyers withdrew a whopping $769 million from KiwiSaver to assist with purchasing their first home. This is a big deal!

These are people who will have been in situations like ours - frustrated with paying rent or living with family members - who were just ready to move on to the next stage of their lives.

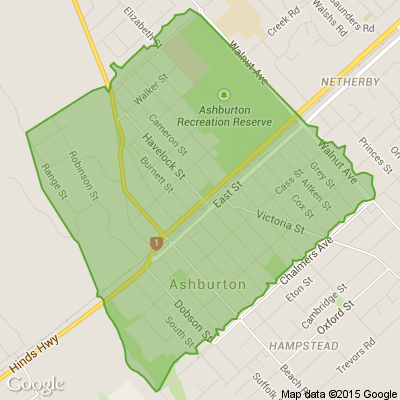

They made a successful step in the direction of home ownership. Guess what? First home ownership is absolutely within your reach in Canterbury! In fact, Interest.co.nz recently named Christchurch as the most affordable major centre for First Home Buyers since research began in 2005!

So how to become one of those smiling home owners we see in so many ads?

A deposit of 10% is required. Hopefully, you’ve been taking advantage of KiwiSaver or you’ve some savings put aside and/or perhaps some family assistance is available.

To become a confident first home buyer, it’s a great idea to arm yourself with as much information as possible so walking into a property, its value and what it is worth is not a mystery!

It’s a good idea to also remember that real estate agents are generally paid commission based on a percentage of the price the property is sold for, and their contract is to work for the vendor of the property.

Right off the bat, acknowledge that they do not have your financial interest at heart, so it is important to be aligned with someone who does. I can tell you where to easily find the information you need regarding the area you are interested in and even the property you are considering purchasing.

As a Mortgage Adviser, I am here to answer any questions. This is the guarantee that I provide and the relationship that I have with my first home buyer clients. I am here for every step of the process.

In fact, getting the mortgage is the easy part! My focus will also be on ensuring that there is a plan for repaying the mortgage efficiently, thereby saving many thousands of dollars in interest over the term of the loan, to ensure that your financial future is secure.

The great thing about my role is that there is no charge for my services. I am paid by the lender and/or insurance companies. I am independent and not aligned to anyone, so I can give the right advice for your situation and your circumstances and my service is FREE.

Let’s have a chat and work out what stage you are at and where to from here………. I offer a FREE 30-minute video or phone chat which can be booked to work in with your day.

Click on the link below to reserve your time. Looking forward to chatting or just give me a call on 0274 368 367. 🏡🏡😘😍

What's your favourite recipe for courgettes?

Kia ora neighbours. If you've got a family recipe for courgettes, we'd love to see it and maybe publish it in our magazine. Send your recipe to mailbox@nzgardener.co.nz, and if we use it in the mag, you will receive a free copy of our January 2025 issue.

It’s Riddle Time – You Might Need an Extra Cup of Coffee!

Nobody has ever walked this way. Which way is it?

Do you think you know the answer to our daily riddle? Don't spoil it for your neighbours! Simply 'Like' this post and we'll post the answer in the comments below at 2pm.

Want to stop seeing riddles in your newsfeed?

Head here and hover on the Following button on the top right of the page (and it will show Unfollow) and then click it. If it is giving you the option to Follow, then you've successfully unfollowed the Riddles page.

Poll: Do you think NZ should ban social media for youth?

The Australian Prime Minister has expressed plans to ban social media use for children.

This would make it illegal for under 16-year-olds to have accounts on platforms including TikTok, Instagram, Facebook and X.

Social media platforms would be tasked with ensuring children have no access (under-age children and their parents wouldn’t be penalised for breaching the age limit)

.

Do you think NZ should follow suit? Vote in our poll and share your thoughts below.

-

84.7% Yes

-

13.9% No

-

1.4% Other - I'll share below

Loading…

Loading…