Know what’s happening

Access the private noticeboard for verified neighbours near you. Keep informed about any suspicious activity, send urgent updates to your neighbours when required and discuss emergency planning.

Get to know your neighbours

Browse the directory and start getting to know your neighbours. Don’t want to post to the whole neighbourhood? Send a private message.

Buy, sell and give away

Want to declutter your garage? Buy some used household items? Give away some garden stuff? Become a verified neighbour to browse and post items for sale. Trading is simple when everyone lives nearby.

Thank you for using Neighbourly

You may receive an email confirmation for any offer you selected. The associated companies will contact you directly to activate your requests.

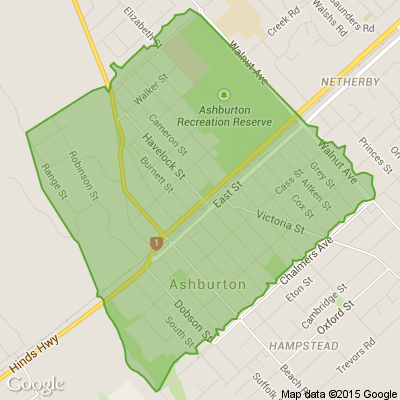

Deborah from Ashburton District

Please go CRAZY and SHARE,SHARE SHARE!!! Thank you for helping us to achieve our goal.Go to PledgeMe to pledge and view rewards. www.pledgeme.co.nz...

Jo Haywood Reporter from Homed

Hi neighbours! The judges from the Beautiful Awards, run by Keep New Zealand Beautiful, are keen to find out who you would pick as the most beautiful NZ town - out of the two finalists below.

The two towns have been picked as they demonstrate sustainable and environmentally conscious … View moreHi neighbours! The judges from the Beautiful Awards, run by Keep New Zealand Beautiful, are keen to find out who you would pick as the most beautiful NZ town - out of the two finalists below.

The two towns have been picked as they demonstrate sustainable and environmentally conscious behaviours across key areas, such as litter prevention & waste minimisation, community beautification, recycling projects and sustainable tourism.

Have you heard of the Beautiful Awards? they celebrate environmental excellence and recognise positive actions taken by communities, businesses, schools, individuals and councils, in local and urban areas to protect and enhance their local environments

Note: this poll runs externally from the Beautiful Awards and responses will not be included in the judging process.

Director / lawyer from Kiwilaw

You need probate because your brother had more than $15,000 in Kiwisaver. Your brother's lawyer holds his will. That lawyer says they will get probate for you. That's a relief!

Before you go ahead, ask them what it will cost. (If you don't ask, they don't have to tell you … View moreYou need probate because your brother had more than $15,000 in Kiwisaver. Your brother's lawyer holds his will. That lawyer says they will get probate for you. That's a relief!

Before you go ahead, ask them what it will cost. (If you don't ask, they don't have to tell you beforehand.)

Ask them whether that includes the High Court fee.

If they say something that totals more than $600, maybe ask them to wait until you get back to them.

Then take a look at our website. (Hint: in most cases, we charge $400, to which you add the High Court fee of $200.)

It's entirely up to you - although, as the executor and trustee of the estate, you do have a duty to act in the best financial interests of the beneficiaries.

All the best

Cheryl Simes

Darren from Ashburton District

If you need new LOCKS on DOORS to home or work.Nows the time to do it because summers coming warming up and the LOW LIFES are at it again. So don't wait for it to happen to you. Call ME FOR ALL YOUR HOME AND WORK SECURITY. We can make it safe and secure. Ph 0272351288

Trish from Trish Greenwood Mortgage & Insurance Adviser

Yes!! It has been years since credit cards have moved their interest rates with most being well in excess of 20%!! ANZ has reduced its Visa cash advances interest rate by -2.00% to 20.95%, which takes it down to the same level as its Purchase rate on most cards. No other credit card rates … View moreYes!! It has been years since credit cards have moved their interest rates with most being well in excess of 20%!! ANZ has reduced its Visa cash advances interest rate by -2.00% to 20.95%, which takes it down to the same level as its Purchase rate on most cards. No other credit card rates changed.💳

This is why Banks - especially the big 4, make such HUGE profits!! So if you have credit card debt that is not going to be paid off and fully cleared within the next 3 to 6 months, please talk to me.

This is especially important if you are trying to save to buy your First Home. 🏡😘

Some clients I helped recently had a Mortgage, Motor Trade Finance, QCard and CC debt. We were able to consolidate the debts and reduce the monthly payments from $1,034 per month to $490 per month, which is a monthly saving of $544!!!

The even better news is that most of that savings was able to be directed towards their mortgage which will reduce the term of their mortgage by 16 years!! This will save them in excess 💲136,000💰💰💰in interest costs over the term of their loan.

Being mortgage smart makes your financial future secure!

Trish

0274 368 367

trish@trishgreenwood.co.nz

We’re looking for young gardeners (aged 5-15 years) who love getting into the garden, whether it’s growing fruit and veggies or flowers for the butterflies and bees. A Yates Budding Young Gardener may have been gardening for a few years and know how to sow seeds, rustle up a few radishes and… View moreWe’re looking for young gardeners (aged 5-15 years) who love getting into the garden, whether it’s growing fruit and veggies or flowers for the butterflies and bees. A Yates Budding Young Gardener may have been gardening for a few years and know how to sow seeds, rustle up a few radishes and turn lemons into lemonade. Or even just starting out!

Yates Budding Young Gardener will become a Yates brand ambassador for one year AND win an amazing family trip for four, to the Gold Coast, Australia.

The five day trip will include flights, accommodation, a rental car and tickets to the Queensland Gardening Expo (if travelling in July) and a three day pass to Gold Coast theme parks - Warner Bros. Movie World, Sea World and Wet ‘n’ Wild.

The competition is open to all keen gardeners aged 5-15 years. Entries close 17th September - so enter your Budding Young Gardener now!

Enter now

Trish from Trish Greenwood Mortgage & Insurance Adviser

Sometimes life can work out better than expected. Going back a few years I would not have predicted that I would be working in a job that I really loved!!

I started my early career in banking and finance and did the whole 8-5pm thing for many years. In my later years as I moved along the … View moreSometimes life can work out better than expected. Going back a few years I would not have predicted that I would be working in a job that I really loved!!

I started my early career in banking and finance and did the whole 8-5pm thing for many years. In my later years as I moved along the corporate ladder I even got to do the 7am to 7pm and beyond thing. ☹ ☹

The biggest issue for me was that I wanted to buy a home for myself and my daughter. I found paying rent every month frustrating. I didn’t want to be paying off someone else’s mortgage when I could just as easily be paying off my own. I know everyone has to pay rent for a period in their lives but I thought it was just an expense, so why couldn’t I make it my own expense and get the benefit of paying my own rent to myself!!!

This went on for far longer than it should, as I worked, raised my daughter and juggled the costs of childcare, rent, insurance, living expenses etc. It certainly wasn’t easy. So I saved every dollar I could and after a time and with a few sacrifices (wine, dinners out, wine, holidays, wine) I was able to get a deposit together.

In the first instance, I was just so happy that my loan had been approved and that I would actually be able to move into my own home. 😊 😊 My mortgage was over 30 years which seemed fine with me. It took me quite a while to figure out that I actually needed to manage my mortgage rather than just go along with what the lender told me. I realised that paying even just a little more each week made such a huge difference to the amount of interest I would pay over the term of the loan AND it also reduced my loan term which meant I was paying off my loan faster!! Yayyy.

When I did the calculations I was amazed to see the amount of interest I was saving over the term of the loan – it was over $100,000 thousand dollars! I didn’t even have to stay in the same house to do this! I could also trade up and achieve the same savings.

So, because I learnt this knowledge on the job as it were, I could apply it to my own situation and it allowed me to create more financial freedom for myself.

Fortunately, a few years ago, I and realised that life was passing by quickly and it was time for me to get real and do a job where I could really make a difference and help people on a one to one basis. I think my volunteer work as a Business Mentor helped me to understand that this is where my skill set lay and I get a real buzz from seeing people develop themselves and their financial wellbeing.

During this time, the people I met all had mortgages and families, some with or without children and it became really clear to me that there was a huge knowledge gap about the process of how to get a mortgage and perhaps more importantly, how to repay it!! So …………. ”light bulb moment” I decided to do the study to become a mortgage adviser and become self-employed!

Like all things in life, the more you do things the more confident and adept you become even if it can be complicated. However, for most of us, getting a mortgage is not something we do every day and because the outcome can really impact on ourselves and our families, it can be downright nerve-racking. Also, we are usually very emotionally invested in the process never mind trying to balance it with our usual work and family commitments!

Despite limited media coverage, the fact is for the year ended June 2018, 34,343 First Home Buyers withdrew a whopping $769 million from KiwiSaver to assist with purchasing their first home. This is a big deal!

These are people who will have been in situations like ours - frustrated with paying rent or living with family members - who were just ready to move on to the next stage of their lives.

They made a successful step in the direction of home ownership. Guess what? First home ownership is absolutely within your reach in Canterbury! In fact, Interest.co.nz recently named Christchurch as the most affordable major centre for First Home Buyers since research began in 2005!

So how to become one of those smiling home owners we see in so many ads?

A deposit of 10% is required. Hopefully, you’ve been taking advantage of KiwiSaver or you’ve some savings put aside and/or perhaps some family assistance is available.

To become a confident first home buyer, it’s a great idea to arm yourself with as much information as possible so walking into a property, its value and what it is worth is not a mystery!

It’s a good idea to also remember that real estate agents are generally paid commission based on a percentage of the price the property is sold for, and their contract is to work for the vendor of the property.

Right off the bat, acknowledge that they do not have your financial interest at heart, so it is important to be aligned with someone who does. I can tell you where to easily find the information you need regarding the area you are interested in and even the property you are considering purchasing.

As a Mortgage Adviser, I am here to answer any questions. This is the guarantee that I provide and the relationship that I have with my first home buyer clients. I am here for every step of the process.

In fact, getting the mortgage is the easy part! My focus will also be on ensuring that there is a plan for repaying the mortgage efficiently, thereby saving many thousands of dollars in interest over the term of the loan, to ensure that your financial future is secure.

The great thing about my role is that there is no charge for my services. I am paid by the lender and/or insurance companies. I am independent and not aligned to anyone, so I can give the right advice for your situation and your circumstances and my service is FREE.

Let’s have a chat and work out what stage you are at and where to from here………. I offer a FREE 30-minute video or phone chat which can be booked to work in with your day.

Click on the link below to reserve your time. Looking forward to chatting or just give me a call on 0274 368 367. 🏡🏡😘😍

Have you received some great service from your local GP? What about a dentist or optometrist? Leave a review for them on the Whitecoat website and be in to win $3,000.

Whitecoat is all about helping Kiwis make more informed decisions about their healthcare providers.

Find out more

The Team from Neighbourly.co.nz

There has been a lot of discussions lately about the neighbourly etiquette when it comes to rubbish bins. We're sure everyone has had a moment when their bin is full on collection day and the question arises around what to do with the rest of the rubbish. We're keen to hear what you … View moreThere has been a lot of discussions lately about the neighbourly etiquette when it comes to rubbish bins. We're sure everyone has had a moment when their bin is full on collection day and the question arises around what to do with the rest of the rubbish. We're keen to hear what you think - is it okay to put rubbish in a neighbour's bin?

Is it fair game to use a neighbour's bin if it's out on the street? Vote in the poll below!

The Ministry of Foreign Affairs and Trade

We want to help all New Zealanders benefit from trade wherever they are. That’s why the Government is consulting New Zealanders to develop a Trade for All policy. We want to hear your views on trade policy and what matters most to you. Take our short poll, share your comments or make a submission… View moreWe want to help all New Zealanders benefit from trade wherever they are. That’s why the Government is consulting New Zealanders to develop a Trade for All policy. We want to hear your views on trade policy and what matters most to you. Take our short poll, share your comments or make a submission here.

- How can trade support sustainable economic development that takes into account the impact on our environment?

- How can trade benefit our regions and support women, Maori and small and medium enterprises to succeed globally?

Come to a public meeting or hui. You can find the details and register here.

Find more information about Trade for All and our current trade policy at www.haveyoursay.mfat.govt.nz

Have your say on Trade for All. Submissions close on 14 October 2018.

Have your say

Dylan from West Melton

Gday! We have a couple of creative builders available for weekend work to sort any of your carpentry needs. Give us a bell if we can be of any assistance:)

Reporter The Press

Christchurch isn't rebuilding, writes Vicki Anderson. We are ''reimagining'' ourselves as a city.

Mei Leng Wong Reporter from NZ Gardener & Get Growing

We are looking for great tomato growing tips and/or photos of your tomato harvest from last year. Do you have a piece of tomato growing wisdom to share with other New Zealand gardeners? Maybe a variety that does well for you, a way to treat or prevent diseases, or a recipe for homemade fertiliser. … View moreWe are looking for great tomato growing tips and/or photos of your tomato harvest from last year. Do you have a piece of tomato growing wisdom to share with other New Zealand gardeners? Maybe a variety that does well for you, a way to treat or prevent diseases, or a recipe for homemade fertiliser. Or do you have an amazing photo to share ... like this one from tomato enthusiast Minette Tonoli. Email us your tip (mailbox@nzgardener.co.nz) and/or share your pic in the comments... if we publish your tip or your photo we will send you a free copy of NZ Gardener magazine!

Director / lawyer from Kiwilaw

Public Trust charges $280 for a simple will, $500 for more complicated wills.

For simple wills, I like the look of ewills.co.nz which produces online wills for $100, but I haven't seen their output yet. Until further notice, I'd be happy to look over the results without charge if … View morePublic Trust charges $280 for a simple will, $500 for more complicated wills.

For simple wills, I like the look of ewills.co.nz which produces online wills for $100, but I haven't seen their output yet. Until further notice, I'd be happy to look over the results without charge if people use them, if you email the results to me, just to know what they produce. (There are also other online providers - I think the cheapest I found was about $45 - the same offer applies - I'd be interested to see what they produce and to know whether they are user friendly, and I'll let you know without charge whether what they have produced is 'legally okay'.)

For a will from scratch I would charge between $150 and $700 depending on complications and whether you provide information to me efficiently e.g. by email rather than by personal interview. HOWEVER, I don't provide a will-storage service - you have to make your own arrangements for keeping the original will safe. ALSO, I don't spend time witnessing the will - I send it to you with instructions for you to arrange to sign in front of two adults who are not mentioned in the will.

Mirror wills - where spouses make wills that are identical except for reversing the will-maker and executor - shouldn't cost more than a single will (in my opinion). It takes 30 seconds to reverse those details. If someone tries to charge you twice as much, just do one will and then copy it out yourself, swapping the details.

The main value that lawyers add to the will-making process is advice about how to deal with tricky situations. If you don't have a tricky situation, you don't need a lawyer's will.

Trish from Trish Greenwood Mortgage & Insurance Adviser

It's been a challenging couple of weeks for one of my clients as we moved through the process of buying their first home! This knowledge is good for everyone so thought I would share.

Lesson 1.

1) If you are wanting to purchase a repaired home that was previously an "as is where is … View moreIt's been a challenging couple of weeks for one of my clients as we moved through the process of buying their first home! This knowledge is good for everyone so thought I would share.

Lesson 1.

1) If you are wanting to purchase a repaired home that was previously an "as is where is property" - the first thing you need to make sure you can get insurance. Insurers have really tightened up in this area and getting insurance for homes like this, has become quite difficult. This is because there has been quite a bit of bad publicity around poorly repaired homes and also insurers are wanting to limit the risks they take on! (Given they are in the business of risk - this seems a bit over the top to me)……but, this is the reality.

If the vendor of the property does not have all the paperwork from EQC and the Scope of repair, plus an Engineers report signed off by a Chartered Professional Engineer (CPEng) you will find it difficult to get insurance and without insurance you can't get a mortgage.

Thankfully in the end………All turned out ok for my clients because:

a. They had done their homework

b. There was a full engineers report of the work that had been completed and signed off.

🏡😘😍I love happy endings!!

Lesson 2.

2) Always, always, always!! Have your contents cover with the same insurance company that your house dwelling is insured with!

Remember it is your contents cover that provides you with the "alternative accommodation cover" in the event of a disaster. Seems weird I know!! But it does. So imagine trying to deal with two insurance companies if you had a disaster!! Some people in Canterbury know this only too well, as this situation arose in the EQ's!

Happy to talk if you need to. PS: I don't do Home and Contents insurance but I have great contacts and now even more after this week!! 😂😂😂

Loading…

Loading…

Are you sure? Deleting this message permanently removes it from the Neighbourly website.

Loading…

Loading…

Buyers $535,000+

Buyers $535,000+

Marketed by Karen McRae

Marketed by Karen McRae

$759,000

$759,000

Marketed by Stephan Knowler

Marketed by Stephan Knowler

By Negotiation

By Negotiation

Marketed by Karen McRae

Marketed by Karen McRae

Deadline Sale

Deadline Sale

Marketed by Stephan Knowler

Marketed by Stephan Knowler

Tender

Tender

Marketed by Maurice Newell

Marketed by Maurice Newell

$875,000 +

$875,000 +

Marketed by Suzy McPherson

Marketed by Suzy McPherson

Auction

Auction

Marketed by Jo McIntosh

Marketed by Jo McIntosh

© Neighbourly 2024