Know what’s happening

Access the private noticeboard for verified neighbours near you. Keep informed about any suspicious activity, send urgent updates to your neighbours when required and discuss emergency planning.

Get to know your neighbours

Browse the directory and start getting to know your neighbours. Don’t want to post to the whole neighbourhood? Send a private message.

Buy, sell and give away

Want to declutter your garage? Buy some used household items? Give away some garden stuff? Become a verified neighbour to browse and post items for sale. Trading is simple when everyone lives nearby.

Win a brand new home!

For just $15, you could win a fully furnished home in Clarks Beach, Auckland worth over $1 million. Buy your tickets today!

Thank you for using Neighbourly

You may receive an email confirmation for any offer you selected. The associated companies will contact you directly to activate your requests.

The Team from Wellington Water

We are moving into the second week of the 24 week project to renew the wastewater pipe in Gibbons Street, Upper Hutt.

On 18 March 2019, the Gibbons Street roundabout will continue to be partially closed. This means that traffic heading to SH2 will be diverted via Victoria Street and Pine Avenue, … View moreWe are moving into the second week of the 24 week project to renew the wastewater pipe in Gibbons Street, Upper Hutt.

On 18 March 2019, the Gibbons Street roundabout will continue to be partially closed. This means that traffic heading to SH2 will be diverted via Victoria Street and Pine Avenue, around the north and east side of the roundabout.

All traffic exiting off SH2 into Gibbons Street will be diverted at the roundabout to left-turn only into Riverbank Street and back to Gibbons Street via Pine Avenue and either Victoria Street or McParland Street.

It is also expected that in a couple of weeks some properties in Gibbons Street will be affected regarding property access. We will be in touch with those property owners well before this happens.

Raewyn Richardson from

Innoxa products have been designed to enhance the beauty of sensitive or troublesome skin without compromising quality or performance. Used in conjunction with the range of specialised skincare, each cosmetic is created to care with Dermatologically Tested, gentle formulas that truly enrich the … View moreInnoxa products have been designed to enhance the beauty of sensitive or troublesome skin without compromising quality or performance. Used in conjunction with the range of specialised skincare, each cosmetic is created to care with Dermatologically Tested, gentle formulas that truly enrich the health of the skin.

Garry Tranter from Price My House for Free Limited

While the general rule of thumb is to match your repayments to your income frequency, if you want to save on interest or pay your loan off quicker, that might not be the best option.

Here, we take a look at repayment frequency options to help you choose the right repayment frequency for you.

… View moreWhile the general rule of thumb is to match your repayments to your income frequency, if you want to save on interest or pay your loan off quicker, that might not be the best option.

Here, we take a look at repayment frequency options to help you choose the right repayment frequency for you.

WEEKLY

If you get paid weekly, then making your mortgage payments weekly is probably the best option.

By making more frequent payments, you will usually be saving on interest costs, as interest is usually calculated daily on the outstanding balance – so by paying weekly, you are paying down the principal amount faster. It might not seem like a lot, but it does add up…

By making four weekly payments, you will save interest compared to paying once a month. However, it does depend on how your mortgage repayments are structured to be repaid.

If they are structured to be paid weekly, then you probably won’t be making much in the way of interest savings, as that will already be factored into the total interest cost; if, however, your payment schedule is set up as monthly or fortnightly, then making more regular payments should save you interest.

FORTNIGHTLY

If you get paid fortnightly, but have your mortgage repayment frequency set up as monthly, you could then pay half the monthly mortgage payment each fortnight (which will save interest) or the full amount every second fortnight and pay your other bills on the other fortnight.

This may be most beneficial if your other bills are a similar amount to the monthly mortgage payment.

If you do make your payments fortnightly, but your loan schedule is monthly, paying half your required monthly payment each fortnight will provide two benefits – you will save on interest from making more regular payments AND your loan could be paid off quicker, as you will end up making an additional repayment each year (as there are 26 fortnights in a year, which is equal to 13 monthly payments).

MONTHLY

While making one monthly payment may not give you the potential interest savings that more frequent repayments can, it does make sense if you only get paid monthly – because making your payments late will cost you more in interest and fees in the long run.

However, if you do only make your payments monthly, paying a little bit extra each time will help you to reduce your interest costs and your loan term.

Matt Tso Reporter from Upper Hutt Leader

Despite an increase in household recycling Upper Hutt residents recycle less than half than half that of their regional neighbours.

*If you don't want your comments used in an article, just add NFP at the end of your post.

17 replies (Members only)

Comedy mixes with music in this fast-paced, colourful, and entertaining adaptation of Rossini’s The Barber of Seville from New Zealand Opera.

Almaviva loves Rosina, and Rosina loves Almaviva. But Bartola stands in their way. So Almaviva turns to his barber, Figaro, to help him out. With a few… View moreComedy mixes with music in this fast-paced, colourful, and entertaining adaptation of Rossini’s The Barber of Seville from New Zealand Opera.

Almaviva loves Rosina, and Rosina loves Almaviva. But Bartola stands in their way. So Almaviva turns to his barber, Figaro, to help him out. With a few good tunes and his razor-sharp wit, will Figaro win the day or will Almaviva be “hair today, gone tomorrow’?

One day only – get your tickets!

Book you tickets here!

Visit Chilton Saint James School during March for one of our Open Days, Friday 22 March, 9.00am - 11.00am or Sunday 24 March 1.00pm - 3.00pm.

Discover what makes Chilton the best choice for girl’s education in Lower Hutt. Experience our small classes from Preschool through to Year 13, and our … View moreVisit Chilton Saint James School during March for one of our Open Days, Friday 22 March, 9.00am - 11.00am or Sunday 24 March 1.00pm - 3.00pm.

Discover what makes Chilton the best choice for girl’s education in Lower Hutt. Experience our small classes from Preschool through to Year 13, and our strong academic focus with an internationally recognised curriculum.

Chilton offers specialist teachers including Te Reo, Dance, Music and Art, all within a safe, supportive, and nurturing environment.

At Chilton, you can also discover our Dance Centre, free before school care, and a wealth of extra-curricular activities for your daughter.

Book now!

Irene from Elderslea

Fundraising – for cottage maintenance

Miro St Cinema Tuesday 26 March 2019: Film to view: Stan & Ollie

Come for 7pm for film starting at 7.30pm for viewing.

Cost is $20 per ticket each

We will supply nibbles. Drinks purchase from the Cinema.

Raffles - bring your loose change!

30 … View moreFundraising – for cottage maintenance

Miro St Cinema Tuesday 26 March 2019: Film to view: Stan & Ollie

Come for 7pm for film starting at 7.30pm for viewing.

Cost is $20 per ticket each

We will supply nibbles. Drinks purchase from the Cinema.

Raffles - bring your loose change!

30 tickets still available, Contact Yvonne or Janice.

RSVP as soon as possible.

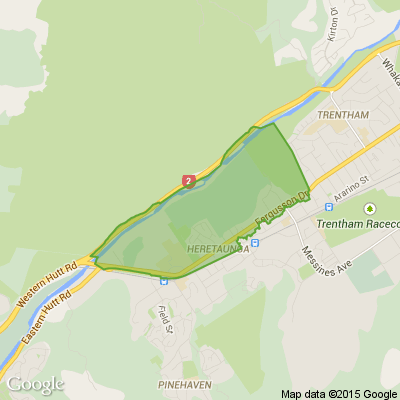

Golder Cottage, 707 Fergusson Drive, Upper Hutt

www.goldercottage.co.nz... & Facebook page

(04) 5278285 Email: vibranthv@gmail.com

Carol from Akatarawa

Looking to buy Gunnera Plants or roots and water Iris's if anybody has any

The Team from

Making the decision to move into a retirement village can be a daunting experience. With so many things to consider, we want to make the process a little easier.

Visiting a village is the best way to obtain a true appreciation of what life will be like, take in the sights and sounds, and observe… View moreMaking the decision to move into a retirement village can be a daunting experience. With so many things to consider, we want to make the process a little easier.

Visiting a village is the best way to obtain a true appreciation of what life will be like, take in the sights and sounds, and observe the general atmosphere. Find out why Bill and Leonie from Jane Mander Retirement Village in Whangerei, found the support and care they needed from the village community.

Find out more

Loading…

Loading…

Are you sure? Deleting this message permanently removes it from the Neighbourly website.

Loading…

Loading…

© Neighbourly 2024