Know what’s happening

Access the private noticeboard for verified neighbours near you. Keep informed about any suspicious activity, send urgent updates to your neighbours when required and discuss emergency planning.

Get to know your neighbours

Browse the directory and start getting to know your neighbours. Don’t want to post to the whole neighbourhood? Send a private message.

Buy, sell and give away

Want to declutter your garage? Buy some used household items? Give away some garden stuff? Become a verified neighbour to browse and post items for sale. Trading is simple when everyone lives nearby.

Win $20,000 makeover CLOSES 31 Dec 2024

Apply up to $2,000 for new flooring for your organisation.

Thank you for using Neighbourly

You may receive an email confirmation for any offer you selected. The associated companies will contact you directly to activate your requests.

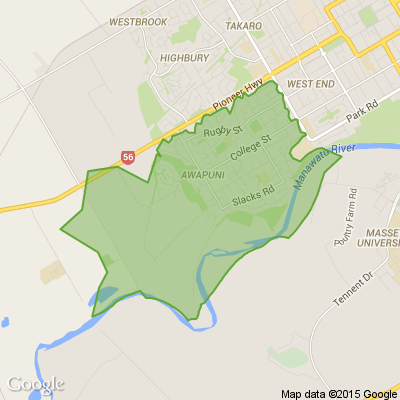

Debra from Highbury - Westbrook

Hi guys I'm trying to re-home my mums cat as she has passed away and unfortunately I can't have him either He is a ginger and white fixed male cat and is 12yrs old, he would love to go to a quite place with someone that is going to love him just the way my mum did. He does have longer … View moreHi guys I'm trying to re-home my mums cat as she has passed away and unfortunately I can't have him either He is a ginger and white fixed male cat and is 12yrs old, he would love to go to a quite place with someone that is going to love him just the way my mum did. He does have longer hair but he loves to be brushed and still plays with his toys. He will shower his new owner with lots of cuddles and loves as he is missing his pats from his mum..... we have 2 weeks to re-home him if anyone knows of someone or they can take him please let me know as I don't want to take him to the SPCA.

If you need more forms or accessibility formats,visit www. census.govt.nz, or call 0800 236 787 for help. Find out more

Yvonne from West End

Jewelry needs home Was bought to go on a cruise never made it all of it made by Lovisa matching colors in necklace and earrings no diamonds sorry never used or worn would look nice if someone was going out for the evening asking 50 for the whole lot someone… View moreJewelry needs home Was bought to go on a cruise never made it all of it made by Lovisa matching colors in necklace and earrings no diamonds sorry never used or worn would look nice if someone was going out for the evening asking 50 for the whole lot someone will enjoy it

Robert Anderson from Curtain Clean Palmerston North

Pic of us surgically removing a cat from a curtain

The Team from Resene ColorShop Palmerston North

Refresh drawers with an ombre paint effects using tonal Resene paint colours.

Find out how to paint your own with these easy instructions.

Joanne from Palmerston North Central

Do you enjoy playing 500? Join us from 6.45 pm at the PN Bridge Clubrooms, cnr Cook and Cuba Streets, 1st , 3rd and 5th Fridays each month. Play starts at 7.00 pm. $5.00, includes supper and prizes. No partner required. For more info Ph Jo 06 3574910 or 021 1395367.

Hurry, our Big SellOff is on Now! Save up to 60% off on NZ made beds and mattresses

Get the zzz's you deserve!

Shop online or at your nearest Beds4U store!

- 60-Night's Comfort Guarantee

- 100% NZ Owned and Operated Business

- 19 stores across North Island

- Earn Flybuys with us… View moreHurry, our Big SellOff is on Now! Save up to 60% off on NZ made beds and mattresses

Get the zzz's you deserve!

Shop online or at your nearest Beds4U store!

- 60-Night's Comfort Guarantee

- 100% NZ Owned and Operated Business

- 19 stores across North Island

- Earn Flybuys with us

We have the bed for you @ BEDS4U.

Your Local Sleep Experts.

Find out more

Stu from Aokautere - Fitzherbert

Tv and Free view box 24" excellent condition txt 0212644294

Price: $60

Michelle from Linton

DO YOU LOVE TO SING?

Let's Get Singing can help you find your star within! We provide one on one vocal lessons. So what are you waiting for, give us a call!

PH/TEXT 027 2240 170

OR MESSAGE US ON FACEBOOK www.facebook.com...

OR VISIT OUR WEBSITE letsgetsinging.weebly.com...

WE LOOK … View moreDO YOU LOVE TO SING?

Let's Get Singing can help you find your star within! We provide one on one vocal lessons. So what are you waiting for, give us a call!

PH/TEXT 027 2240 170

OR MESSAGE US ON FACEBOOK www.facebook.com...

OR VISIT OUR WEBSITE letsgetsinging.weebly.com...

WE LOOK FORWARD TO HEARING FROM YOU AND HELPING YOU ON YOUR SINGNG JOURNEY! 😊🎤

If you need more forms or accessibility formats, visit www.census.govt.nz, or call 0800 236 787 for help. Find out more

Sheryn from Sheryn Prince Real Estate

Number of first home buyers getting into a home of their own at an eight year low

The number of first home buyers getting into a home of their own at the start of this year was at its lowest level since 2015.

According to the latest Reserve Bank figures, banks approved just 1166 mortgages … View moreNumber of first home buyers getting into a home of their own at an eight year low

The number of first home buyers getting into a home of their own at the start of this year was at its lowest level since 2015.

According to the latest Reserve Bank figures, banks approved just 1166 mortgages for first home buyers in January, the lowest number in any month of the year since January 2015 (apart from April 2020 when housing market activity came to a standstill due to the Covid lockdown).

And as mortgage interest rates have been steadily rising, the amount being borrowed by first home buyers has been steadily decreasing.

In January this year the average value of the loans approved to first home buyers was $548,885. That's down by $46,513 (-7.8%) from its May 2022 peak of $595,398.

However almost a third of those loans approved in January this year were low equity loans to first first home buyers with less than a 20% deposit.

In January this year, 370 low equity mortgages were approved to first home buyers.

Although that is a low number, it made up 31.7% of all the mortgage approved to first home buyers in January.

That was the first time the low equity loans to first home buyers have gone above 30% of the total since November 2021, when house prices also hit their cyclical peak.

While rising interest rates have reduced the number of first home buyers getting into their own homes, they are also affecting the amount they are paying for them.

Although higher interest costs mean fewer aspiring first home buyers are getting into a home of their own, they are proving to be a more resilient part of the market than either investors or existing owner-occupiers.

However the low overall number of mortgages being approved to aspiring first home buyers suggests that home ownership likely remains an impossible dream for many.

The Team from Neighbourly.co.nz

There's some real goodies on Neighbourly Market in our FREE section, and we want to see even more!

If you've got some things getting dusty in the garage that could use a new home, list them on Neighbourly as free in the next 48 hours and you'll go in to win one of 5 x $50 … View moreThere's some real goodies on Neighbourly Market in our FREE section, and we want to see even more!

If you've got some things getting dusty in the garage that could use a new home, list them on Neighbourly as free in the next 48 hours and you'll go in to win one of 5 x $50 Prezzy® cards!

List an item now

Loading…

Loading…

Are you sure? Deleting this message permanently removes it from the Neighbourly website.

Loading…

Loading…

Buyers $729,000+

Buyers $729,000+

Marketed by Catherine Richardson

Marketed by Catherine Richardson

Buyers $889,000+

Buyers $889,000+

Marketed by Blair Alabaster

Marketed by Blair Alabaster

Deadline Sale

Deadline Sale

Marketed by Taylor Quine

Marketed by Taylor Quine

By Negotiation

By Negotiation

Marketed by Eileen Farquhar AREINZ

Marketed by Eileen Farquhar AREINZ

Buyers $585,000+

Buyers $585,000+

Marketed by Catherine Richardson

Marketed by Catherine Richardson

Buyer Enquiry Over $980,000

Buyer Enquiry Over $980,000

Marketed by Stu Fleming

Marketed by Stu Fleming

© Neighbourly 2024