Know what’s happening

Access the private noticeboard for verified neighbours near you. Keep informed about any suspicious activity, send urgent updates to your neighbours when required and discuss emergency planning.

Get to know your neighbours

Browse the directory and start getting to know your neighbours. Don’t want to post to the whole neighbourhood? Send a private message.

Buy, sell and give away

Want to declutter your garage? Buy some used household items? Give away some garden stuff? Become a verified neighbour to browse and post items for sale. Trading is simple when everyone lives nearby.

Wondering about something in your neighbourhood?

Whether it's a new building going up or a strange noise you keep hearing, ask your neighbours here.

Thank you for using Neighbourly

You may receive an email confirmation for any offer you selected. The associated companies will contact you directly to activate your requests.

Brian from New Lynn

The removal and rehoming of 100 to 200 wild chickens in Titirangi Village is expected to begin in October.

Auckland Council has confirmed that green asset management specialists, Treescape, will be undertaking the removal of the famed chooks. Although the process may sound straightforward, … View moreThe removal and rehoming of 100 to 200 wild chickens in Titirangi Village is expected to begin in October.

Auckland Council has confirmed that green asset management specialists, Treescape, will be undertaking the removal of the famed chooks. Although the process may sound straightforward, Auckland Council delivery business manager Sam Pohiva says a number of variables will make their removal from the West Auckland suburb "a complex operation". "It will involve the installation of coops for the chickens, a period of pre-feeding before their removal, and housing of the chickens at a different location once captured until re-homing is possible," says Pohiva. The rehoming process is expected to take four weeks. The council assures the birds will be captured humanely, with vets on-board to monitor their health and welfare during removal. Aucklanders who have expressed interest in housing the chickens will also be thoroughly vetted to ensure the birds are heading to humane conditions. The Waitakere Ranges Local Board made the decision to remove and rehome the birds in July after a significant increase in their population caused public health and safety issues. A number of Titirangi residents and businesses had raised concerns over the "disruptive" chooks, with many correlating the local increase in rats to the feeding of the chickens. Capturing and rehoming the 100 to 200 birds is expected to cost between $17,500 and $22,500 - meaning a price tag of up to $112 a chicken.

==========================================================

New Zealand School of Food & Wine

Over three sessions, learn to cook classic recipes you find in New Zealand's innovative cafes. Start with learning basic knife skills and then transform your vegetable cuts into delicious salads followed by learning how to make blueberry muffins, cookies, eggs benedict and more!

… View moreOver three sessions, learn to cook classic recipes you find in New Zealand's innovative cafes. Start with learning basic knife skills and then transform your vegetable cuts into delicious salads followed by learning how to make blueberry muffins, cookies, eggs benedict and more!

Registration link below!

Katherine from Small Business Accounting - Avondale

Spending hours every month reconciling your books just so you can work out your GST? Let SBA work on the numbers and let them tell you what GST you need to pay. It will save you time and money and you can concentrate on your business or doing the things you love.

Talk to your SBA Avondale about … View moreSpending hours every month reconciling your books just so you can work out your GST? Let SBA work on the numbers and let them tell you what GST you need to pay. It will save you time and money and you can concentrate on your business or doing the things you love.

Talk to your SBA Avondale about cost-effectively managing your GST, so you don’t have to.

SBA Avondale

1962 Great North Rd, Avondale, Auckland 1026.

09-600 1489

The Team from Neighbourly.co.nz

We're looking for all the kindness heroes in your neighbourhood and we want to hear all about them. Nominate someone today, to be our weekly AMI Kind Neighbour and your special neighbour could feature in the community newspapers around New Zealand as an inspiration to us all. Plus, if your … View moreWe're looking for all the kindness heroes in your neighbourhood and we want to hear all about them. Nominate someone today, to be our weekly AMI Kind Neighbour and your special neighbour could feature in the community newspapers around New Zealand as an inspiration to us all. Plus, if your nomination is chosen and features in the community newspapers then you'll both receive a $50 Prezzy® card from us!

The Team from Auckland Council

It’s time to vote for the Auckland you love in the local elections.

Don’t leave it to the last minute.

Get your papers back early and relax. Last day to post is Tuesday 8th October, or drop them in a ballot box before midday Saturday 12 October.

Find out more

The Team from

Are your curtains or blinds stained? Mildewed? Spreading harmful mould spores or unpleasant odours?

Come talk to our specialist curtain and blind cleaners!

Textile Curtain Cleaning has you completely covered. Our experienced curtain and drape cleaning team know exactly how to remove ugly … View moreAre your curtains or blinds stained? Mildewed? Spreading harmful mould spores or unpleasant odours?

Come talk to our specialist curtain and blind cleaners!

Textile Curtain Cleaning has you completely covered. Our experienced curtain and drape cleaning team know exactly how to remove ugly stains, blemishes and marks from your window furnishings.

We are located in Wairau Park, Glenfield. We have been cleaning curtains for Aucklanders for over 20 years so come and see us at 5A Kaimahi Road, Wairau Park or visit our website.

For the best fabric curtain and blind cleaning in Auckland, please contact us to obtain your free quote.

Open Mon - Fri 9am - 5pm

Saturday 9am - 12pm

Call us 09 473 5350

Find out more

Amanda Saxton Reporter from Western Leader

A Sikh priest has been sentenced to seven months home detention for molesting children inside a temp…

14 replies (Members only)

Kendall Hutt Reporter from Western Leader

Nǐ hǎo neighbours. Angeline Tan has been teaching Mandarin for three years and in this time has seen interest soar from 80 students learning the language to 180 students. Are you learning Mandarin? What do you love about the language? How are you celebrating Chinese Language Week?

Monday - Fee Free Money Transfer to Sri Lanka

Tuesday & Thursday - Fee Free Money Transfer to India

Wednesday - Fee Free Money Transfer to Pakistan

We make it fee free so you can send more love to your dearest overseas! Call us now at 0508 411 111 for more information.

Brian from New Lynn

The tax department began sending out letters to people who had not paid enough tax on their KiwiSaver investments in May prompting an outcry from people worried about getting an unexpected tax bill. In June, the IRD revealed 450,000 people had been paying the wrong tax rate on KiwiSaver and other … View moreThe tax department began sending out letters to people who had not paid enough tax on their KiwiSaver investments in May prompting an outcry from people worried about getting an unexpected tax bill. In June, the IRD revealed 450,000 people had been paying the wrong tax rate on KiwiSaver and other PIE (portfolio investment entity) investment schemes. But weeks later it updated the figure to 1.5 million people with 950,000 estimated to have overpaid tax of around $42 million and 550,000 underpaying tax of between $45m to $50m in the last tax year. People who have underpaid tax will get a bill telling them how much they need to pay but those who have overpaid won't get a refund. From July, over-payers have been sent letters urging them to change their rates.

An IRD spokeswoman said it had so far sent out just over 930,000 letters to customers who are on the wrong PIR rate for KiwiSaver. "We are sending the letters in batches so not everyone who is due a letter has received one so far." But it expected the mail-out to be complete in November and for there to be more than a million letters in total. "We do not have a definitive final number at this time." Auckland financial adviser Rachelle Bland said she knew two individuals who had now received letters from the IRD advising that they were paying too much tax.

One is on the top 28 per cent tax rate and has been told she should only be paying 10.5 per cent. The woman was told: "Your investment with KiwiSaver scheme [scheme name removed] is being taxed at 28 per cent. We've calculated your rate based on the income details we hold for you and the table below, and suggest for the 2020 tax year you change it to 10.5 per cent. A tax rate of 10.5 per cent is for people who earn $14k or less in taxable income. The letter also stated: "It is important that the rate your KiwiSaver scheme is taxed at is correct. If the rate is too low, you may have a tax bill at the end of the year. If the rate is too high you are unable to claim a refund."

The second is also on the top tax rate but should be on 17.5 per cent because she earns between $14,001 and $48k in taxable income. Both were told to contact their KiwiSaver providers directly to change the rate. But Bland said many of those receiving the letters may not be aware who their KiwiSaver provider is or how to get in contact with them. "I would like to think it will be acted on but I think it is going to take a massive education campaign."

Some people may have been on the wrong tax rate since joining KiwiSaver potentially costing them hundreds of dollars in overpaid tax and lost returns. Bland was part of a group of financial advisers which warned the government about the over-taxation of KiwiSaver more than a year ago. Inland Revenue has said it only became able to identify which KiwiSaver members were underpaying or over-paying tax since switching to a new IT system in April. Bland believes part of the problem lies with auto-enrolment forms which sign people up to KiwiSaver but do not allow them to specify which prescribed investor rate they need to be on. People are automatically put on the highest rate of 28 per cent and then must tell their provider to change it. But Bland said by the time the money got to the provider - three months later - many were not aware they needed to change the rate or had forgotten about it. She is running a parliamentary petition to get the IRD to change its forms so people have to specify what prescribed investor rate they should be on from the start and has written to the IRD and its minister Stuart Nash. In a response from Tony Donoghue, manager of the commissioner's correspondence at the IRD, said the KiwiSaver forms were designed to transfer an employee's contributions to an investment company and the requirements should not be confused with the tax rules which applied to PIEs. "The PIE rules require investors to choose a PIR at the time they invest, so the entity pays the correct amount of tax on investment earnings. This obligation is set out in product disclosure statements issued to investors when they join a scheme.

"Regardless of how people join, every investor receives a product disclosure statement, which provides information on what taxes the investor is required to pay." All PIE providers are legally required to check investors are on the right rate every year. KiwiSaver providers send out annual letters to get people to switch change rates but say they don't have much of a response. Donoghue said officials were considering what legislative changes could be made to improve the PIE regime. "This could include authority for Inland Revenue to automatically notify investment entities when investors have not declared an appropriate PIR." However changes would require parliamentary approval, he added.

==========================================================

Join us for a day of indulgence by stepping inside the pages of one of New Zealand's favourite magazines.

We've hand picked five fabulous locations to showcase a variety of homes, reflecting local design flare and style. The tours are self-driven, and give attendees the opportunity to … View moreJoin us for a day of indulgence by stepping inside the pages of one of New Zealand's favourite magazines.

We've hand picked five fabulous locations to showcase a variety of homes, reflecting local design flare and style. The tours are self-driven, and give attendees the opportunity to take in the best scenery the region has to offer, try some quirky cafes or eateries along the way, and also visit our Hub; a one stop shop for all your house tour information and where they can meet the editorial team behind their much-loved magazine.

The Team from

We are halfway through our desexing campaign and we still have over 200 bookings available for Snip ’n’ Chip!

From 16 September to 4 October, we are working with local vets to offer FREE DESEXING AND MICROCHIPPING for residents in 12 Auckland suburbs.

If your feline family member is undesexed… View moreWe are halfway through our desexing campaign and we still have over 200 bookings available for Snip ’n’ Chip!

From 16 September to 4 October, we are working with local vets to offer FREE DESEXING AND MICROCHIPPING for residents in 12 Auckland suburbs.

If your feline family member is undesexed and unmicrochipped you don’t want to miss out on this opportunity.

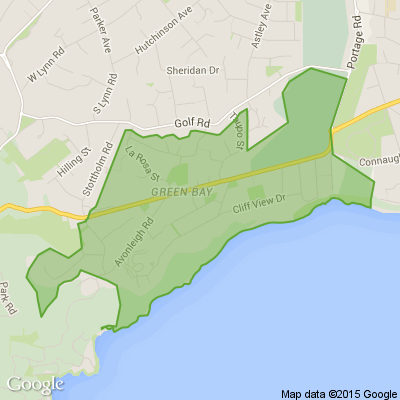

If you live in one of the below areas, PLEASE CALL US NOW on 09 256 7310 to book in:

Avondale, Clendon Park, Glen Eden, Henderson, Mangere, Manurewa, Mt Roskill, Mt Wellington, Onehunga, Otahuhu, Papakura, or Papatoetoe.

This is our last Snip 'n' Chip campaign of the year and we desperately need more people to take up our Snip 'n' Chip offer! 😭😭

Please leave a voice message with your name and number and we will get back to you as soon as we can!

Loading…

Loading…

Are you sure? Deleting this message permanently removes it from the Neighbourly website.

Loading…

Loading…

© Neighbourly 2024