Know what’s happening

Access the private noticeboard for verified neighbours near you. Keep informed about any suspicious activity, send urgent updates to your neighbours when required and discuss emergency planning.

Get to know your neighbours

Browse the directory and start getting to know your neighbours. Don’t want to post to the whole neighbourhood? Send a private message.

Buy, sell and give away

Want to declutter your garage? Buy some used household items? Give away some garden stuff? Become a verified neighbour to browse and post items for sale. Trading is simple when everyone lives nearby.

Lost something?

Or found something? Let's reunite! Share about it here.

Thank you for using Neighbourly

You may receive an email confirmation for any offer you selected. The associated companies will contact you directly to activate your requests.

Did you know hearing aids are now rechargeable? Whether you’re thinking of an update or need your first set of hearing aids, now’s the time to ask your local hearing expert, Peter O’Brien, about the latest technology.

For a limited time, we’re offering a FREE charger* with the newest … View moreDid you know hearing aids are now rechargeable? Whether you’re thinking of an update or need your first set of hearing aids, now’s the time to ask your local hearing expert, Peter O’Brien, about the latest technology.

For a limited time, we’re offering a FREE charger* with the newest rechargeable technology! Book now to learn more!

Find out more!

The Team from

Breathe new life into your curtains when you choose to have them professionally cleaned and repaired.

Come talk to our specialist curtain and blind cleaners!

Our experienced curtain and drape cleaning team know exactly how to remove ugly stains, blemishes and marks from your window … View moreBreathe new life into your curtains when you choose to have them professionally cleaned and repaired.

Come talk to our specialist curtain and blind cleaners!

Our experienced curtain and drape cleaning team know exactly how to remove ugly stains, blemishes and marks from your window furnishings.

Our full service includes our team taking down your curtains and blinds, cleaning them and then rehanging your blinds. Alternatively, you can choose to deliver your blinds to our North Shore cleaning facility. Customers that drop off and pick up their blinds receive a discount off the cleaning cost.

We have been cleaning curtains and blinds for Aucklanders for over 20 years so come and see us at 5A Kaimahi Road, Wairau Park or visit our website.

For professional curtains and blind cleaning throughout Auckland, please contact Textile Curtain Cleaning to obtain your free quote.

Open Mon - Fri 9am - 5pm

Saturday 9am - 12pm

Call us 09 473 5350

Find out more

Fiona from Henderson

I absolutely love this idea.

I really do hope that this is the way of the future, I really do.

With all the amount of space rapidly vanishing for graveyards now, this is such a beautiful way to visit your loved ones.

So simple but so serene.

So minimal but so fulfilling.

So affordable and so … View moreI absolutely love this idea.

I really do hope that this is the way of the future, I really do.

With all the amount of space rapidly vanishing for graveyards now, this is such a beautiful way to visit your loved ones.

So simple but so serene.

So minimal but so fulfilling.

So affordable and so beautiful.

www.youtube.com...

It is quite normal for you to be taking frequent looks around your bedroom. In the process, have you ever felt that there is something special missing from this divine space at home?

The problem here is that it is so difficult for you to put your finger on exactly what that thing is that could … View moreIt is quite normal for you to be taking frequent looks around your bedroom. In the process, have you ever felt that there is something special missing from this divine space at home?

The problem here is that it is so difficult for you to put your finger on exactly what that thing is that could potentially add value to your bedroom. You need not panic though for when it comes to ensuring your bedroom is fitted with everything it should have such that it becomes the ideal place to unwind and relax in, we have all your bases covered.

New Zealand School of Food & Wine

Some of the fantastic cakes prepared by our Diploma students during the special two days of learning confectionary including a tribute to our native New Zealand bird, Kiwi!

Erena from Te Atatu Peninsula

Selling on trademe:

www.trademe.co.nz...

We have a matching set of 2-seater leather couches, purchased from Freedom Furniture 4 years ago. Excellent condition. No major scuffs or scratches. From a NON smoking home. Just moved in to a new house and no longer have room for these.

Modern. Clean. … View moreSelling on trademe:

www.trademe.co.nz...

We have a matching set of 2-seater leather couches, purchased from Freedom Furniture 4 years ago. Excellent condition. No major scuffs or scratches. From a NON smoking home. Just moved in to a new house and no longer have room for these.

Modern. Clean. Timeless design. They look great in an office or a lounge. Hard wearing and long lasting.

Size: L 1750 x W 900 x H 700

You are bidding on a single couch. E-mail if you would like to view, are interested in purchasing both, or if you have any other questions. Best of luck. Pick up only in Te Atatu Peninsula.

Price: $500

Brittany Keogh Reporter from Western Leader

Hi neighbours, A survey of 2000 Kiwis has shown different generations place value different qualities when looking for love. Young adults, aged 16 to 34, ranked a sense of humour as the most important quality in a partner, where as most 55- to 64-year-olds viewed sharing values as more important … View moreHi neighbours, A survey of 2000 Kiwis has shown different generations place value different qualities when looking for love. Young adults, aged 16 to 34, ranked a sense of humour as the most important quality in a partner, where as most 55- to 64-year-olds viewed sharing values as more important than sharing a laugh together. Younger people were also more likely to judge potential partners on their looks and perhaps unsurprisingly, more likely to meet their significant other online. What do you think is the most important quality in a partner and how did you meet yours? Please write "NFP" if you don't want your comment to appear in stories.

Reporter Sunday Star Times

Hi neighbours, my name is Brittany and I am a reporter with the Sunday Star Times. I'm looking for a family who's willing to talk to me about what local elections mean for them - the big issues that will affect you this year such as rates, transport etc.

Please get in touch if you are… View moreHi neighbours, my name is Brittany and I am a reporter with the Sunday Star Times. I'm looking for a family who's willing to talk to me about what local elections mean for them - the big issues that will affect you this year such as rates, transport etc.

Please get in touch if you are available to chat today or tomorrow - you must be willing to be quite open, as you may be asked about budget, household income and if you own your own home etc. To get in touch, email brittany.keogh@fairfaxmedia.co.nz (Please note that we will need you to be named and photographed for the story).

Debrin from Glen Eden

Do you buy Kiwi-made? How much more are you willing to pay for something that comes from a NZ business? Can you chat to me for a story? Message me on debrin.foxcroft@stuff.co.nz

Brittany Keogh Reporter from Western Leader

Auckland Council has been accused of ageism for paying members of its youth panel 30 per cent less than its older advisors.

Members of its youth advisory board, who are aged 14 to 24, are paid $173 per meeting, but a review has recommended the council raise their pay to match the rate of $250 … View moreAuckland Council has been accused of ageism for paying members of its youth panel 30 per cent less than its older advisors.

Members of its youth advisory board, who are aged 14 to 24, are paid $173 per meeting, but a review has recommended the council raise their pay to match the rate of $250 per meeting, that members of other demographic panels get.

What do you think? Should young people get a pay rise? Read the full story here.

Baptist from Avondale

Hi All,

Please join us to a fun filled exercise to Bollywood music at a fraction of the cost. See the attached Flyer

When: Every Saturday at 9 am for one hour

Where: New Lynn Community Center, 45 Totara Avenue, New Lynn,

Cost : $ 5 per session (casual) or $30 for 10 sessions

Please bring a … View moreHi All,

Please join us to a fun filled exercise to Bollywood music at a fraction of the cost. See the attached Flyer

When: Every Saturday at 9 am for one hour

Where: New Lynn Community Center, 45 Totara Avenue, New Lynn,

Cost : $ 5 per session (casual) or $30 for 10 sessions

Please bring a bottle of water and a towel

First session absolutely free. Please come and give us a try and I guarantee that you will want more of it. Bring along friends and family. Hope to see you there

If you need more information please contact any one of us on the flyer.

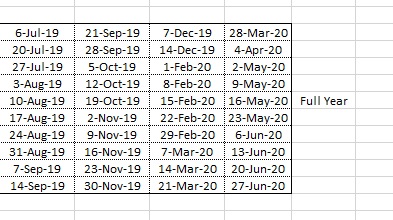

New Season is starting tomorrow. Hurry and join before the spots fill up

We have our sessions through out the year come rain come shine please see our attached schedule

Those who have attended our class in the past can you please post your comments/recommend us

Here are some samples of our exercise

www.facebook.com...

www.facebook.com...

www.facebook.com...

Contact

Baptist

021815040

Loading…

Loading…

Are you sure? Deleting this message permanently removes it from the Neighbourly website.

Loading…

Loading…

© Neighbourly 2025