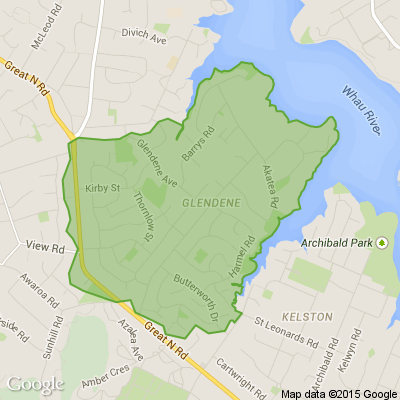

Know what’s happening

Access the private noticeboard for verified neighbours near you. Keep informed about any suspicious activity, send urgent updates to your neighbours when required and discuss emergency planning.

Get to know your neighbours

Browse the directory and start getting to know your neighbours. Don’t want to post to the whole neighbourhood? Send a private message.

Buy, sell and give away

Want to declutter your garage? Buy some used household items? Give away some garden stuff? Become a verified neighbour to browse and post items for sale. Trading is simple when everyone lives nearby.

Wondering about something in your neighbourhood?

Whether it's a new building going up or a strange noise you keep hearing, ask your neighbours here.

Thank you for using Neighbourly

You may receive an email confirmation for any offer you selected. The associated companies will contact you directly to activate your requests.

The Team from Resene ColorShop Henderson

Transform an old wooden drawer into a stylish shelf and paint it your favourite Resene colour.

Make the most of this weekend with this easy step by step project idea from Resene.

Find out how to create this quick and easy project yourself.

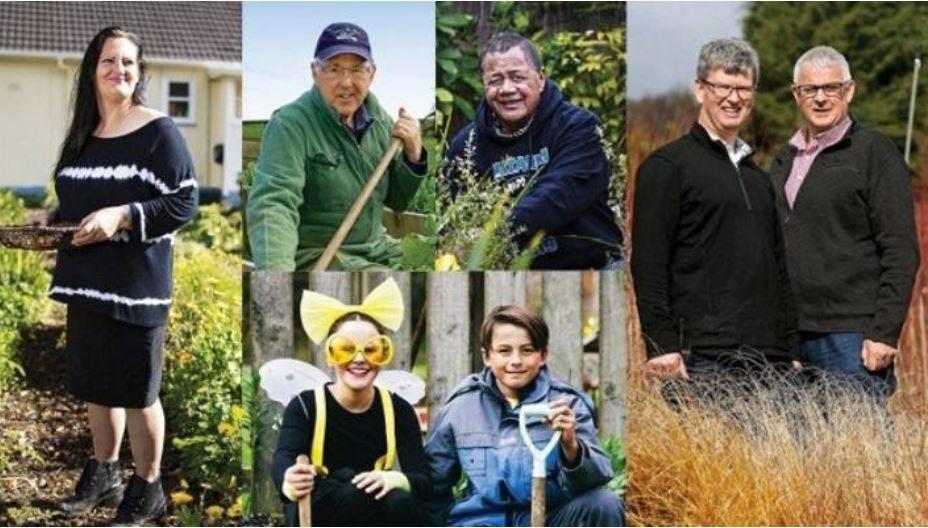

Mei Leng Wong Reporter from NZ Gardener & Get Growing

Voting closes tomorrow, November 1. These amazing homegrown heroes were shortlisted after a public call for nominations from gardeners all over the country, and you can read about their wonderful work here. Then don't forget to click through to vote for your favourite!

New Zealand School of Food & Wine

Join Riki Bennett on a guided walk to learn more about our natural world and to plants and berries that you can safely eat.

This is followed by Riki's presentation on local flora and Māori tanga before a gourmet lunch prepared on our balcony in our own Kai Cooker that smokes, steams and … View moreJoin Riki Bennett on a guided walk to learn more about our natural world and to plants and berries that you can safely eat.

This is followed by Riki's presentation on local flora and Māori tanga before a gourmet lunch prepared on our balcony in our own Kai Cooker that smokes, steams and transforms the food.

Includes:

- Guided walk

- Foraging masterclass presentation

- Gourmet lunch

When: Saturday, 16 Nov from 9:00 am to 2:00 pm

The Team from AAA Auto Parts

Do you have a vehicle that is taking up space and becoming an eyesore? At AAA Auto Parts we dismantle and wreck cars. We will pay top cash whether your car is dead or alive!

* $300 - $3000 for small cars

* $700 - $10,000 for 4x4 utes, vans, 4WD, trucks and buses

* Same day removal

* Free … View moreDo you have a vehicle that is taking up space and becoming an eyesore? At AAA Auto Parts we dismantle and wreck cars. We will pay top cash whether your car is dead or alive!

* $300 - $3000 for small cars

* $700 - $10,000 for 4x4 utes, vans, 4WD, trucks and buses

* Same day removal

* Free quotes over the phone

We will beat any prices in the market by 10%.

Support your local business.

Give us a call on ** 0800 50 00 01 ** and we will be happy to have a chat.

Enquire now

Alex Neighbourly Lead from Henderson

In excellent condition

Never used, assembled the coffee table only.

Dimension: 1000mm x 500 mm x 400mm

Negotiable

Are you an aspiring author? Entries for the Sunday Star Times short story awards are now open!

The winning entry will receive a $3000 prize + there’s a $500 prize for students in our secondary school competition.

Full details and the entry form are here.

Tricia from Henderson

Only 3 days until St Doms Henderson have their Car Boot Sale. Come along and support one of your local schools.

Diane Costello from Waitakere Central Community Arts Council

Evan Woodruffe painting demonstration at The Studio, Corban Estate Arts Centre, Henderson, THURSDAY, 31ST OCT 10AM-11.30AM. Contact Diane on 021 232 4438 or wccac@xtra.co.nz if you are keen to have a look!

Brian from New Lynn

Inland Revenue is "five years late" to tackle the mammoth issue of the country's estimated billion-dollar "hidden economy", a tax expert says. A Victoria University and IRD study released in April estimated that New Zealand is missing out on about $800m in its annual tax … View moreInland Revenue is "five years late" to tackle the mammoth issue of the country's estimated billion-dollar "hidden economy", a tax expert says. A Victoria University and IRD study released in April estimated that New Zealand is missing out on about $800m in its annual tax take. Chartered Accountants Australia and New Zealand believe this is likely to be in excess of $1b each year. The tax department yesterday announced it had carried out a series of unannounced raids on hospitality businesses in the Queenstown and Central Otago region - new measures in a bid to curb unreported cash sales and staff being paid cash under the table. Using court-issued search warrants, IRD raided three hospitality businesses and made unannounced visits to six others. It seized wage records, computers and other business records, along with information on employer-provided accommodation, working for Families Tax credits and payroll matters. It found that businesses were paying staff in cash without PAYE being deducted, and documents revealed some were making cash deposits into private bank accounts without being returned for GST or income tax. IRD says it would continue to use the strategy to catch operators failing to comply with tax law, but Terry Baucher, founder of Baucher Consulting, says IRD has in recent years took its "eye off the ball" as it became "too focused" on its business transformation programme rather than growing hidden economy. "The business transformation programme should have happened five years ago, at the very latest," Baucher told the Herald. "We don't know the size of the hidden economy and that's the point coming out ... my view is that this sector is bigger than people realise, much bigger. "Inland Revenue is now returning its focus on to this matter. With its new upgraded systems I think it has got better data matching abilities - they are now enhanced, so it can now go about this with a renewed figure." Baucher said New Zealand's GST system enabled it to pick up on under-the-table activity. "Because our GST is so comprehensive, I believe that policymakers, that means Inland Revenue, have been a little complacent about the extent of the cash economy." IRD estimates that approximately $256m worth of income was not reported in 2018 and 2019 - about $108.8m identified in 2019, and $148m in the 2018 year. According to it annual report, for every $1 spent on efforts to crack down on the hidden economy, IRD received about $6 in return revenue last year. "They targeted getting $4.59 [back] so they were 20 per cent above what they were expecting," said Baucher said. IRD research has found that the proportion of people participating in cash jobs was beginning to decline. In 2011, 34 per cent of people said they participated in cash jobs. This is now down to 27 per cent, while just 16 per cent of people said they were now likely to ask for a cash price discount compared with 27 per cent previously. About 49 per cent of people said cash jobs were acceptable, down from 72 per cent from 2011. Baucher said IRD's unannounced visits and raids to its assessed "high-risk businesses" would have a positive impact on tackling New Zealand's hidden economy. He said New Zealand could also follow Sweden by implementing a surcharge or similar for cash payments. Inland Revenue customer segment leader for micro, Richard Philp, said there were 90 tax evasion prosecution cases before the court, and that IRD was making progress on the issue. "The construction industry and the hospitality industry are two industries that typically represent a higher level of cash transactions, and particularly with the hospitality industry, there are small amounts one-by-one but collectively they can build up to be substantial amounts of cash suppressed and not declared annual GST returns," Philp said. The IRD first began focusing on a crackdown on cash payments in the hospitality industry about three years ago. Unannounced visits to businesses, however, are a new strategy the tax department is undertaking to clawback tax owed. "Cash jobs undercut legitimate operators so our goal is not to prosecute everyone but to have enough examples and representation around our enforcement work that helps guide people to do the right thing."

==========================================================

“Parkable really has been a game-changer for me.” - Jon Kowski

By renting his single parking spot on Parkable, Jon makes an extra $2,500 each year. That means less stress about finances and a better lifestyle.

How much could you earn with Parkable? Find out by clicking through!

If you … View more“Parkable really has been a game-changer for me.” - Jon Kowski

By renting his single parking spot on Parkable, Jon makes an extra $2,500 each year. That means less stress about finances and a better lifestyle.

How much could you earn with Parkable? Find out by clicking through!

If you list your space by the 30th of November 2019, you'll go in the draw to win a $50 gift voucher.

Learn more

Loading…

Loading…

Are you sure? Deleting this message permanently removes it from the Neighbourly website.

Loading…

Loading…

$839,000

$839,000

Marketed by Marjka King

Marketed by Marjka King

© Neighbourly 2024