Know what’s happening

Access the private noticeboard for verified neighbours near you. Keep informed about any suspicious activity, send urgent updates to your neighbours when required and discuss emergency planning.

Get to know your neighbours

Browse the directory and start getting to know your neighbours. Don’t want to post to the whole neighbourhood? Send a private message.

Buy, sell and give away

Want to declutter your garage? Buy some used household items? Give away some garden stuff? Become a verified neighbour to browse and post items for sale. Trading is simple when everyone lives nearby.

Seen anything suspicious lately?

Share that informaton with your neighbours here.

Thank you for using Neighbourly

You may receive an email confirmation for any offer you selected. The associated companies will contact you directly to activate your requests.

Vanessa from Avondale

Hi everyone.

I have an Aunty coming to stay from Australia and am looking for a walker with a seat. Does anyone have one for sale at a reasonable price?

Thanks Vanessa

Negotiable

Sharon from Te Atatu South

Women's size 16-18 top:

www.trademe.co.nz...

Women's size 16 sleeveless jacket:

www.trademe.co.nz...

Men's grey size XL shorts:

www.trademe.co.nz...

To see ALL listings:

www.trademe.co.nz...

Price: $5

Sheralee from Te Atatu Peninsula

When

: Sunday 12 January 2020, 11.00am - Sunday 12 January 2020, 5.00pm

Where: Cranwell Park, 20 Alderman Drive, Henderson, Auckland

Cost Free

Contact Jackie Bridges

elvisfanclubnz@xtra.co.nz

027 490 1126… View moreWhen

: Sunday 12 January 2020, 11.00am - Sunday 12 January 2020, 5.00pm

Where: Cranwell Park, 20 Alderman Drive, Henderson, Auckland

Cost Free

Contact Jackie Bridges

elvisfanclubnz@xtra.co.nz

027 490 1126

Website: elvisnz.com

facebook.com/groups/374223159424520

Come celebrate the king of rock n roll on his birthday at this event.

This awesome free family day boasts entertainers dressed as Elvis himself and a variety of food stalls.

Matt from Henderson

Microsoft has given up to the end of January for people who use Windows 7 to upgrade to Windows 10. Now I have read in this particular article why you shouldn't upgrade to windows 10 because of the automatic updates every 5 min or so and apparently there are ads galore on you open certain … View moreMicrosoft has given up to the end of January for people who use Windows 7 to upgrade to Windows 10. Now I have read in this particular article why you shouldn't upgrade to windows 10 because of the automatic updates every 5 min or so and apparently there are ads galore on you open certain programmes.

www.computerworld.com...

I am not solely convinced that Windows 10 is a better version than Window 7.

Anyone got any comments they would like to share about this?

I have seen on different ads on TV such as Harvey Norman, JB HIFI, that sells laptops for about $200-300 roughly. Now on those laptops they run the Google Chrome software which run for about 2 years, I think? What happens after the user of that Google Chrome software finishes after the 2 year period? Will they have to get a new piece of equipment to get another product with different software on it?

I here Linux is actually a good alternative to Windows. Many different users on Youtube have found that Linux is a better version to use. Yes it might get a user to get your head around the software itself but it seems to be a better choice, or the other thing is get yourself a MAC laptop. Yet different software again. You will have to get around the different file changes too and the different formatting, not like Windows.

Anyways just wanting to say HAPPY NEW 2020! Let's us see what the year bring ahead this year.

Matt

Ryman village living lets you worry less and play more. Experience our retirement villages.

0800 555 103 | rymanhealthcare.co.nz

Find out more

Jay from New Lynn

Since they moved the police helicopter base to Onehunga earlier this year I've noticed a huge increase in overflying of the New Lynn area. The noise pollution from this can be very annoying, especially on days like Christmas Day when we should be able to expect a bit of peace and quiet. … View moreSince they moved the police helicopter base to Onehunga earlier this year I've noticed a huge increase in overflying of the New Lynn area. The noise pollution from this can be very annoying, especially on days like Christmas Day when we should be able to expect a bit of peace and quiet. It's almost become like living near an airport. Sometimes it flies over 10 or more times in one day including up to 3.30 am or later. I don't remember any consultation over this new flight path and the resulting effect on our property values!

26 replies (Members only)

With the help of animal rights group SAFE, Animal Evac New Zealand has sent a specialist team of six trained disaster responders to New South Wales. They are supporting animals and communities impacted by the catastrophic bush fires.

The team has experience in animal disaster management, … View moreWith the help of animal rights group SAFE, Animal Evac New Zealand has sent a specialist team of six trained disaster responders to New South Wales. They are supporting animals and communities impacted by the catastrophic bush fires.

The team has experience in animal disaster management, international humanitarian aid, veterinary medicine, disaster victim identification, paramedicine, incident management, animal control, wildland firefighting and technical animal rescue.

Animal Evac is asking for donations to support their work on the ground in Australia and in responding to future emergencies. They are extremely grateful to the organisations and individuals who have already supported this deployment and helped make it possible.

To learn more about Animal Evac’s work and to stay up to date with their Australian deployment, follow them on Facebook or visit our Website

Donate now

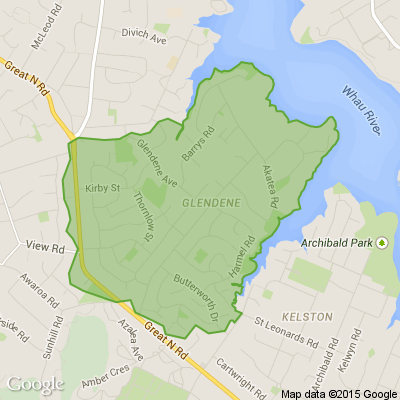

Caroline Williams Reporter from Auckland Stuff

Auckland, your feedback is in regarding the Representation Commission's proposed electorate changes to help deal with overpopulation prior to this year's election.

Changes to the Manukau East electorate received the majority of the objections, with 64. Objectors were concerned the new … View moreAuckland, your feedback is in regarding the Representation Commission's proposed electorate changes to help deal with overpopulation prior to this year's election.

Changes to the Manukau East electorate received the majority of the objections, with 64. Objectors were concerned the new boundary would separate Panmure from Mt Wellington.

Fifty-eight people said the name Helensville would not represent the communities within the electorate, instead suggesting Atuanui, Mahurangi and Kaipara, or keeping the name Rodney.

Hibiscus Coast was put forward as an alternative name by many of the 21 Whangaparāoa objectors.

Boundary changes to Papakura were mostly supported by 22 people, while 22 objectors to the new Flat Bush electorate suggested adding areas from Botany and Manurewa and calling it Takanini, Flat Bush-Takanini, Manukau South, Manurewa East, Totara or Totara Park.

What do you think about the changes proposed for your electorate?

New Zealand School of Food & Wine

This will become a family favourite and a great dish to have in your repertoire.

Potato salad

2 cloves Garlic, crushed

800 g Small potatoes, washed

½ cup Mayonnaise, see recipe below

… View moreThis will become a family favourite and a great dish to have in your repertoire.

Potato salad

2 cloves Garlic, crushed

800 g Small potatoes, washed

½ cup Mayonnaise, see recipe below

2 Tbsp Parsley, chopped

2 Tbsp Mint leaves

1 Tbsp Capers, chopped

1 Gherkin, diced

Classic mayonnaise

1 pinch Salt

1 Egg, 1-2 yolks, room temperature

2 tsp Vinegar, or lemon juice

150 ml Canola oil

Check out the full recipe on the link below.

The Team from Resene ColorShop Henderson

Painted glass bottles make a stylish display on their own or with the addition of dried foliage. The paint is on the inside so they still have that lovely glass sheen.

Make the most of this weekend with this easy step by step project idea from Resene. Find out how to create this quick and easy … View morePainted glass bottles make a stylish display on their own or with the addition of dried foliage. The paint is on the inside so they still have that lovely glass sheen.

Make the most of this weekend with this easy step by step project idea from Resene. Find out how to create this quick and easy project yourself

Nicola from Sunnyvale

Copied and posted from facebook.

Lot of tickets left - details below or go to their page.

The Titirangi Volunteer Fire Brigade is selling raffle tickets to raise funds for Australian bushfires cause. Tickets are $10 each and we have an awesome selection of prizes on offer listed below.

The … View moreCopied and posted from facebook.

Lot of tickets left - details below or go to their page.

The Titirangi Volunteer Fire Brigade is selling raffle tickets to raise funds for Australian bushfires cause. Tickets are $10 each and we have an awesome selection of prizes on offer listed below.

The generosity from the local public and businesses has been outstanding, so much so that we have hit the $5000 prize value limit and have had to turn donations away. Apologies to anyone who tried to donate a prize but couldn't. Please scroll down below the prizes for info on how to purchase tickets and for raffle details. Tickets are on sale until Friday 10th Jan 7pm.

Broadleaf Tree Care: One day of Tree Work, incl Chipper and 2 person crew (Value: $1,200- Must be within 1 hours drive of Ellerslie and booked after Feb 20)

Glen Eden Tennis Club: Family Membership- 2 Adults & up to 4 Kids (Value: $500)

Laurie Kearns Jewellery Ltd: A pair of 9ct gold and sterling silver earrings- pear shaped with oval moon stones (Value: $390)

Little Essentials: 2 prizes- one boys newborn- 6months pack and one girls newborn-6 months pack- including clothing, shoes and bibs (Value $150 each pack)

Playhouse Theatre Inc: 3 prizes- 4x tickets to Alice (Value $80), 4x tickets to Black Adder (Value $100), 4x tickets to West Side Story (Value $120)

TWR Media: 1x year subscription to Deals on Wheels/Farm Trader Magazine (Value $130) and a 1x year subscription to Fishing and Outdoors Newspaper (Value $40)

Hell Pizza Head Office: 4x $50 Hell Pizza Vouchers (Value $200 total)

Janet Martin: Set of 10 Children’s picture books signed by author Janet Martin (Value $200)

David Prentice: Family Photo Portrait Session (Value $300)

Jo Crocker: 4 Hours of gardening work (Value $200- must be in Titirangi area)

Ramada Suites Albany: 1x nights accommodation at Ramada Suites Albany including breakfast (Value $219)

New Lynn Snap Fitness: 2 months free membership including 2x PT sessions (Value $250)

STS Electrical Services Ltd: $200 worth of electrical services (Value $200- must be in West Auckland area)

Queensberry: 1x 14x11 canvas print of your choice (Value $150)

Lauren Malkin- 5x dog walks (Value $100- must be in Titirangi area)

Titirangi Body Mind Balance: 1 hour Professional Reiki or BodyTalk session (Value $80)

Mowing Innovations: Lawn mowing voucher for 1x lawn mowed up to $50 (Value $50- must be in West Auckland area)

Giant Bubbles: $50 voucher to use with Giant Bubbles

Scarlyt Dreams: Necklace (Value $40)

Tickets are $10 each. There are 2500 tickets available and we are hoping to raise $25,000.

Raffle proceeds will be donated in a four way split between the NSW Rural Fire Service, Queensland Fire & Rescue Fire Appeal, Victoria Country Fire Rescue Bushfire Appeal and the Australian Salvation Army Bushfire Appeal.

To purchase a ticket you will need to either a) message the Brigade Facebook page b) email Scott.lovell-gadd@fireandemergency.nz to state how many tickets you would like, and if you have a preference you can select your exact ticket (A,B, C, D, E across red, blue, orange, green and 1-100). Once you have locked in your tickets payment needs to be made to the Titirangi Volunteer Fire Brigade account 12 3488 0050944 00- please include your full name. If you would like to purchase tickets in person with cash please let Scott know and we can arrange to meet at the Titirangi Fire Station one evening this week.

Sale of tickets will end at 7pm Friday 10th Jan and we will have a community member randomly draw the 26 winning tickets at the Titirangi Fire Station on Saturday 11th at 10am. Anyone is welcome to attend. We will publish the winners that afternoon on the Brigade Facebook page. Proceeds will be transferred that day to the four listed benefactors.

Thank you to all the local businesses and members of the community that have donated prizes so generously, we have been blown away by the amount of support that has been given to this great cause. We empathise with the Australian Fire Fighters, especially the volunteers, and the affected communities.

This is being run as Class 2 lotto event. Organiser is Scott Lovell-Gadd, 238 Godley Road, Titirangi

Loading…

Loading…

Are you sure? Deleting this message permanently removes it from the Neighbourly website.

Loading…

Loading…

© Neighbourly 2024