Hurunui confirms 10.98% rates rise as it adopts 10-year plan

By David Hill, Local Democracy Reporter

Councillors hope to complete at least some of their ambitious roading programme after belatedly adopting the Hurunui Long-Term Plan (LTP) on Monday (July 15).

The Hurunui District Council had deferred adopting the 10-year budget for the region by the June 30 deadline, after it failed to get the level of funding it sought from Waka Kotahi NZ Transport Agency.

But councillors accepted a recommendation from council chief executive Hamish Dobbie to stick with an average rates rise of 10.98%, so the council could at least complete some of its roading programme.

While Waka Kotahi’s overall funding had increased, Hurunui’s allocation was not enough to fund the upgrades needed to ensure the resilience of the district’s roading network, Dobbie said at a council meeting on June 25.

But Waka Kotahi's regional relationships director, James Caygill, said the Hurunui District Council’s funding request for the next three years was too costly.

He said it was almost double the council’s funding allocation for the 2021-24 period.

Councillors adopted the LTP on Monday with 10 votes in favour, while councillor Garry Jackson abstained.

Jackson said he could not support increasing staffing costs above the level of inflation, while he found the proposals for the development of the Queen Mary Heritage Reserve in Hanmer Springs did not meet the ‘‘standard of rigor’’ in financial management expected.

Mayor Marie Black said she was pleased with the LTP process.

‘‘This is a piece of work we have been involved in for a very long time, as elected members, in partnership with our staff and with our community.

‘‘We tried something a little bit different by going out as elected members and engaging directly with our community and on reflection I think it was a good decision.’’

The council had consulted on a proposed average rates rise of 12.37%, before instructing staff to go through the budgets with a fine tooth comb.

The staffing allocation was pruned back from 155.41 to 150.05 full-time equivalents and the councillors’ mileage allowance also had a trim.

But the pain is expected to continue, with a 14.49% rates hike predicted for the 2025-26 financial year.

The council consulted on investment in roading, the development of the Queen Mary Historic Reserve and rating for stormwater activities.

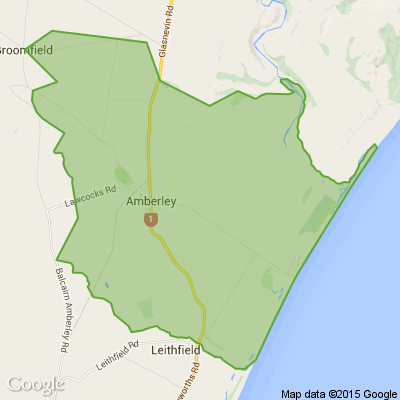

Provision has also been made to replenish the coastal bund at Amberley Beach.

A bund is a type of embankment which protects against the sea.

Amberley Beach ratepayers will be levied $303.56 a year, an increase from $258.83 a year, which was requested by the residents’ group.

■ LDR is local body journalism co-funded by RNZ and NZ On Air.

Poll: Do you think NZ should ban social media for youth?

The Australian Prime Minister has expressed plans to ban social media use for children.

This would make it illegal for under 16-year-olds to have accounts on platforms including TikTok, Instagram, Facebook and X.

Social media platforms would be tasked with ensuring children have no access (under-age children and their parents wouldn’t be penalised for breaching the age limit)

.

Do you think NZ should follow suit? Vote in our poll and share your thoughts below.

-

84.5% Yes

-

14.1% No

-

1.5% Other - I'll share below

What's your favourite recipe for courgettes?

Kia ora neighbours. If you've got a family recipe for courgettes, we'd love to see it and maybe publish it in our magazine. Send your recipe to mailbox@nzgardener.co.nz, and if we use it in the mag, you will receive a free copy of our January 2025 issue.

Railing planters

To gain extra growing space, make and hang these easy-to-build planters on almost any wooden fence or deck railing. Use Resene FX Blackboard Paint so you can easily identify what plants are in each. Find out how to create your own with these easy step by step instructions.

Loading…

Loading…